Was a couple of months back when I last told folks it was time to get out of the weed grow stocks. It wasn’t anything personal, I think there’s a lot of money to be made in the LP space, but just not from spring to the end of summer.

There were a few reasons why.

First, we were coming out of an LP bubble, and anyone who says otherwise is a damned communist.

Second, the LP applicants were starting to get once-impossible to acquire grow licenses at an increased speed.

Third, even at the large end of the sector, it’s still been kind of hard for LPs to earn a profit.

Fourth, everyone with a license has been engaging in massive facility growth programs, to the point where it was getting hard to tell if your favourite LP has 100k sq ft of actual growing plant canopy, or 1000k sq ft, or 10k sq ft with a big empty warehouse around it.

Fifth, recreational use had long been baked into share prices, so there was nothing to hold for. Take Supreme Pharmaceuticals (FIRE.V) as an example; it had been waiting for its sales license for a long time, with a lot of people sitting on the stock waiting for the big day. But once the license came, there was no big jump because folks had already invested into that news before it dropped. More on Supreme later.

Sixth, our good friends at Green Organic Dutchman (TGOD) took a sizable slice of the retail investor’s kitty when they brought Johnny Lunchpail in for what was many people’s first private placement financing, a 2300-investor strong history maker that united small weed investors like few others – but also saw their money held for over a year while the company rumbled to a public listing, with a six-month hold still to come after that listing happens.

Side note: I’m told TGOD will be doing another financing soon, and will again look to the little guy, as they continue to build a massive retail shareholder base. More on that soon.

So when you put all that together, it just seemed like a good time to sit out. And, looking back, it really was. Everything went pear shaped; good companies, bad companies, and almost companies.

But:

But I’m going to say it anyway.

– now is the time to get back in.

Yes, it’s time to load up on your weed stocks again.

Admittedly, a lot of the above reasoning for a downslide still applies. It’s still not easy for LPs to make money in a market that is ruled by regulators that insist on treating the product like heroin. And things are still tight for Joe Retail. And that TGOD money is still tied up for a while. And a lot of people at still a little butt hurt about the mid-July spike in weed stocks, which was followed by a big reckoning a few weeks later.

But what we’re seeing today, despite those issues, is a steady, slow, recalibration in the weed space that indicates better things moving forward.

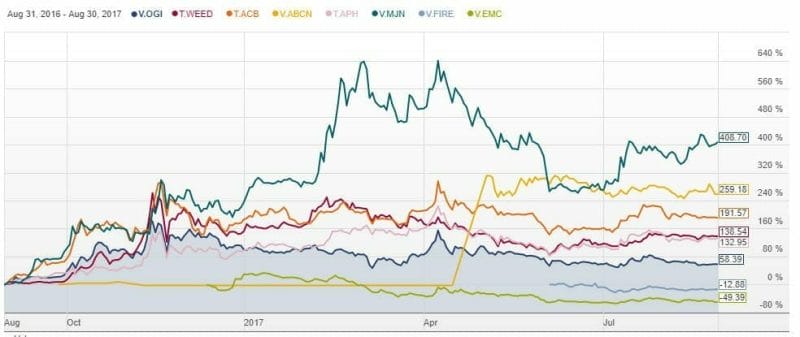

If we look back over the last year, you’ll see some interesting data. First, Cronos (MJN.V) had such a massive first half of 2017, it almost skews the data. But that run was followed by a big drop, which brought them back to the pack.

Q4 2016 was obviously a raging weed industry success period, and Q2 2017 showed a momentary weed spark, followed by a fall off. But if you isolate the data from just the last three months, you see signs of strength returning.

Canopy (WEED.T), Aurora (ACB.V), and Aphria (APH.T) are basically connected; when one jumps, the others follow.

OGI.V breaks downwards because it is run by executives who graduated from the Dick Dastardly Business School and they may still find themselves in class action lawsuit pleasantness due to their alleged habit of giving their (organic) product chemical baths.

Abcann (ABCN.V) has been in business for a while but has only been public for a few months, so it doesn’t have the built in name rec that the big four have and hasn’t had a lot of news to put out yet. And Emblem (EMC.V).. well, Emblem’s IR team hasn’t been able to find its ass with both hands, and I say that while the company continues to be a client of ours. We’d love to help them tell their story, we just can’t find one.

There’s strength among the big guys. But the little guys are more interesting..

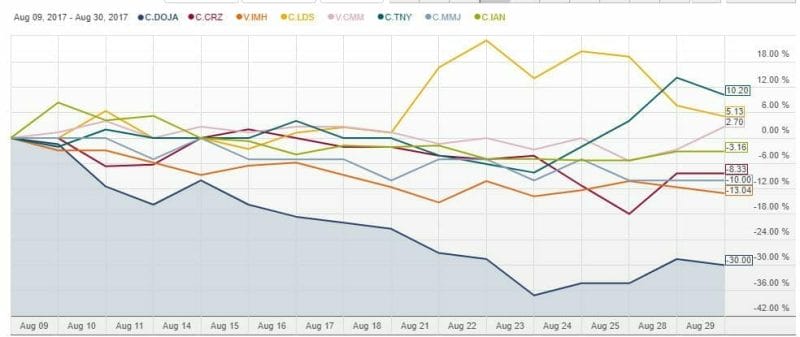

While the big LPs were bouncing, the associated product companies and smaller growers were almost flat. Obviously the newly listed DOJA (DOJA.C) has had a rough opening month, and CannaRoyalty (CRZ.C) got beat up after financials showed a loss, despite a massive increase in asset size, but the others are holding fairly strong.

But if you pull it back to this week, there’s been a notable upward tick. Especially at DOJA, where clearly folks are finding value, and Tinley (TNY.C) which, as we have reported, is nearing the launch of its new THC-infused de-alcoholized alcohol drinks in California.

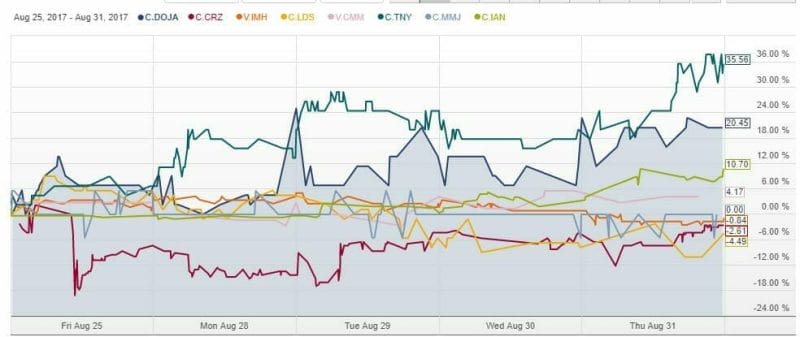

Little DOJA is on a good run, even though they’re still banging in seedlings after their recent blessing of a grow license. They came to market with a thud, right in the midst of a hard sector drop, and certainly folks who saw them dribble from $0.70 to $0.44 in the first few weeks of their public life had reason to be freaked out.

But if you look at the last week, DOJA has moved consistently north, up to $0.53 at the time of writing, an 18% jump for those who thought mid-$0.40’s was just too damn cheap for a f’reals LP based out of BC’s traditional weed belt.

Tinley’s 35% jump last week was a huge uptick, from $0.225 to $0.306, and it hit $0.34 this week. iAnthus (IAN.C) is getting some love after it shoved back at the TSX when the exchange suddenly got all scared of US based weed assets (grow up, you fools), and CRZ has been rapidly making back the ‘weak hands’ loss of earlier in the month.

But let’s dig deeper and see if there are more outliers, where value exists and the market might not have drawn a good look for a while.

First, you’ve got to love the share chart on Cannabis Wheaton (CBW.V). A 35% fall off in the last three months brings it back to where it should have been at the inception of the thing, before money guys took all the mo’ out of the thing by feathering their own nests.

But a lot of those guys are gone now, and though there’s obviously been a sell off, the streaming concept of CBW is not a dumb one. In fact, we’re digging on Metalla Royalty and Streaming (MTA.C) in the gold sector right now, which has employed exactly the same business model in quickly accruing a vast number of chunks of much bigger players in a portfolio that’s gone from zero to over a dozen properties in a matter of months.

At CBW, there’s no grow to maintain, no crew to pay, they simply do financing LOIs with guys who hope to get a license some day, or they do streaming deals with those who have licenses but would like to get bigger quickly. The missing piece for many has been, “what are you gonna do with all that weed?”

Here’s what: National Access Cannabis (BC.V.P/NAC.V).

This, for mine, is stage two of the CBW plan, in which the group positions itself to eventually be the dispensary roll-up play we’ve all been waiting for.

On the board: CBW honcho Chuck Rifici, who has been on the boards of Supreme, Aurora, and Canopy, and CRZ honcho Marc Lustig, who has been rolling up weed deals for a year now in building his own beast.

To start with, they’ll feed dispensaries on First Nations land, what with their investment by the Paskwayak Business Development Corporation, the biz dev arm of the Opaskwayak Cree Nation.

The Cree will move this thing from band to band, where dispensaries will be able to open under their own rules, as they gear up in wait for the federal rules to change and welcome a large, well-funded, professional, squeaky clean organization to turn the dispensary market corporate.

CBW is where they’ll source their product. NAC is where they’ll sell it. I asked Rifici last week if I had the gameplan right, and all he’d say was “There may be synergies between CBW and NAC. Who knows.”

I do. This play is a beast.

And it’s coming out right at the time when CBW is at a historic price low. There’s value to be had here, both in NAC which is supposed to list on September 7, and in CBW which is beat up and value-riffic.

Abcann (ABCN.V) hasn’t caught everyone’s fancy, but one analyst at PI thinks it’s a BUY up to $2+. I think it’s a steal past a dollar. Today? $0.83.

More on BNN.

Speaking of value, Golden Leaf Holdings (GLH.C) is trading in seriously oversold territory. But there’s good reasons for that.

First, former CEO Don Robinson was keelhauled recently and, while losing an unsuccessful CEO is a good thing, it’s also a sign to the market that it’s going to take a while to fix things. Second, the company had a load of debentures due that it couldn’t really afford to pay off, so it did a deal to turn them into stock, at a low price to the original deal. Dilution has been the name of the game at GLH, and that’s not stopping any time soon.

But there are positives. Example one; the directors of the company invested more of their dough into the company. That’s a level of commitment that GLH’s directors have continually made over the last few years, and is indicative that they’re not looking for an exit. Also, the company has made moves into Canada, and Nevada, and expanded its footprint in Oregon. These are good moves, and executed at the right time.

Ultimately, I’ve lost money on Golden Leaf along the way, and for that investment to get back to the starting point, it’d have to trade above a buck. But crying about the past isn’t productive, what’s important is what the future holds. I’m not yet at the point where I’ll double down, despite the stock sitting in the $0.17 range – I kind of want to see the new management really take the wheel on the balance sheet and costs side, and bring the company back to its roots – making as much CBD extract as possible, and selling out of all of it as soon as the stuff is produced. That’s what we bought into, way back when. And it should be enough to make fat profits. Watchlist.

Lifestyle Delivery systems (LDS.C) homers have been eagerly awaiting news of the company’s San Bernadino County Fire Department inspection which is the final permitting round before they can get to production. The bad news is, parts for their extraction machinery were damaged in transit, necessitating a postponement of the inspection. The good news; they’re looking at weeks, not months.

For those who aren’t clued in on the LDS plan, our Twitch livestream from earlier this year is a must-see. It answers lingering questions and shows you the plant first hand.

Watch live video from EquityDotGuru on www.twitch.tv

Massroots (MSRT.OTC) continues its plan of buying up a lot of techy crap in its plan to one day develop an online weed sales app. Otherwise known in the business as ‘buying customers’ and then pointing to your big number of customers as a measure of your success.

Others have pointed this out, so MSRT feels you.

Going forward, the MassRoots team is focused on two core metrics: the number of businesses utilizing our platform and the monthly recurring revenue. While we utilize a number of other data points to analyze and adjust our strategies, fundamentally, these two metrics best reflect the health of our business. We look forward to regularly updating investors on these metrics and our progress.

In other words, don’t look too deep right now.

In the same news release, the boss made a point of talking about how often he’s overpaid for his stock.

Since founding MassRoots four years ago, I have reaffirmed my belief in our Company’s future by purchasing stock on three occasions at $0.50 per share, most recently in July 2017.

It’s at $0.39 right now, for a $40 million market cap than can in no way be justified right now.

Gold explorer junior Platinex (PTX.C) has pulled news out of its back pocket by announcing it would like to jump from mining into the weed game, in a news release that I had to double check to make sure it hadn’t been erroneously sent out two years late.

James R. Trusler, President and CEO of Platinex comments, “Over the last few weeks we have been examining various strategies to capitalize on the lucrative growth of the cannabis sector in North America. While the industry continues to evolve on the regulatory and business fronts, our chief objectives are creating shareholder value in an accretive manner and mitigating risk. The current regulatory framework presents an attractive opportunity for public companies to bridge the funding gap and partner with entrepreneurs in a mutually beneficial manner.”

Their plan? Invest in something, buy something, partner with someone, basically do something weedy. and in the best 2015 fashion, they’ve built a weed article website that they’re going to turn into a mall once millions of people show up. Because nobody’s run that plan into a wall before.

Nutritional High (EAT.C) says it’s going to buy a property in Northern California to grow weed in… once they have the permits to do that… which should happen some time after they get around to applying for them.

The Company expects to be in a position to launch FLI branded products in the California market in early 2018; once the California Department of Public Health begins granting marijuana licenses.

I’m out of patience with these guys. Basically, they’re announcing that they’ll buy a property maybe, if some things happen, sometime. And they’ve released similar news in Nevada. Lame.

Even more lame when you look at their financials and see revenues almost exactly what they were a year ago ($197k for the quarter), and losses of $1.3m for the quarter, up nearly $700k from a year prior – which might be why they put out a news release every time a dispensary places a vape pen order.

Supreme Pharmaceuticals (FIRE.V) announced a supply deal to Aurora Cannabis (ACB.V): Why is this a big deal?

Because I’ve been saying for two years now, it wouldn’t matter to Supreme CEO John Fowler if he never got a sales license (he did, just recently), because his plan from say one was to grow inexpensive greenhouse weed, while tapped into the cheap power right next door, with a monster grow facility, that he would then sell to other LPs with a supply crunch or quality control issues or both.

Abcann used to do this back until it went public, when it decided to keep the good stuff for itself and throw their drowning competitors an anvil, but Supreme wants little more than to take a nice chunk of every other LP’s sales, and this is the first deal in which it’s publicly doing so.

Supreme Pharmaceuticals Inc. (TSXV:FIRE) is pleased to announce its wholly owned subsidiary, 7ACRES, has completed its first sale of dried cannabis to Aurora Cannabis Inc., one of Canada’s leading Licensed Producers. Aurora will sell cannabis procured from 7ACRES to its medical cannabis patients with a producer’s mark specifying the cannabis as “SunGrown by 7ACRES”.

Now, Aurora has been burned before when doing B2B purchasing, when Organigram sent them product tainted with myclobutanil and got them saddled with a product recall (great work, Denis), so before any Supreme product was accepted, it ran the gauntlet.

Since it commenced sales of dried cannabis in 2016, Aurora has grown its patient population to over 19,000 registered patients by focusing on quality cannabis, a premium user experience and a transparent quality assurance program. Prior to completing the transaction, 7ACRES underwent a detailed quality inspection by Aurora including an on-site audit and multiple laboratory tests to ensure the cannabis procured met the Aurora Standard for quality and transparency.

The deal didn’t put the charge on Supreme stock one might expect when actual dollars are announced to be flowing in, but there’s a fairly aggressive bummer element to many of Supreme’s long holders, who seldom appear to believe even the best of news until it’s slapping them upside the head, and sit back waiting for others to move the stock rather than doubling down themselves.

I’ve never been a fan of the Maserati Club promo squad that is THC Biomed (THC.C), so I received a bunch of ‘I told you so‘s last week when they were given the okay to sell dried flower by Health Canada. The stock quickly jumped from $0.30 to $0.67, and then the paper sell-off commenced.

Barely a week later, and it’s at $0.485, despite this promise in the news release:

THC has begun expansions of its current facility and in anticipation of the recreational market, we are currently engaged in acquiring 2 new sites to construct Canada’s largest Indoor cannabis facility. We intend to be Canada’s leader in indoor cultivation.

Over a million square feet?

In the land of the sane, Invictus MD Strategies (IMH.C) is playing things a little more realistic, with news that their first two harvests at Acreage Pharms dropping last month.

Trevor Dixon, CEO of Acreage Pharms commented “The yields from both of the first two harvests exceeded expectations. The additional two harvests in the first week of September will utilize the entire grow space which will maximize yields and generate sufficient data to determine anticipated annual production rates. Acreage Pharms will be in a position to receive the license to sell once the QA team has analyzed the results of the third-party lab tests. This will be a significant milestone for Acreage Pharms.”

See, that’s how you lay the info out clearly. No massive promises, no outlandish predictions, just operational detail that explains why you should sit tight on your undervalued IMH stock.

The company is also pleased to report that Phase 2, a 27,800 square foot purpose built, multiple room production facility, is well under construction with scheduled completion by the end of January 2018. Given the production improvements realized from Phase 1, the new facility is projected to produce up to 4,200 kgs per annum. That represents a 800% increase in production over the existing production facility. The capital costs of constructing the Phase 2 production facility is within the $6 million that was initially budgeted.

Again, patient, achievable deliverables. They’re not planning to be ‘the world’s biggest’ anything, just keep the weed growing and being harvested, keep the pesticides clear, and be bigger tomorrow than they were today.

IMH excepts the next harvest to go down any day now, and the company is sitting on a whopping $28 million in cash, so expect more (and likely better) news soon.

Cronos Group (MJN.V) has expanded into Israel with news that they’ve established a join venture with Kibbutz Gan Shmuel, one of that country’s largest agricultural producers, currently exporting products to 35 countries.

Cronos is of the opinion that they can produce high quality weed there for around $0.40-$0.50 per gram, which would blow the way over-valued International Cannabis Corporation’s (ICC.C) Uruguayan budget-price production of $0.60-$0.75 out of the water, and without that country’s rules about $1 per gram maximum retail pricing to worry about.

Earlier this year, the Israeli Health Ministry’s medical cannabis agency (the “Yakar”) granted Gan Shmuel four codes to establish four distinct commercial operations: (1) propagation and breeding (“Nursery”), (2) commercial cannabis cultivation (“Cultivation”), (3) extraction, formulation and packaging (“Manufacturing”), and (4) patient care and distribution (“Distribution”), (collectively, the “Codes”). Cronos will contribute intellectual property, management expertise, access to its current and future distribution channels, and capital to Cronos Israel. Gan Shmuel will contribute the Codes, agricultural and industrial expertise, land, capital and access to the skilled Gan Shmuel labor force. Cronos will hold a 70% stake in each of the Nursery and Cultivation operations and a 90% stake in the Manufacturing and Distribution operations.

Cronos wins every medal going for expansion over the last year, as well as limiting damage when the rubes at investment partner Hydropothecary (THCX.V) had their own product recall issues. Again. Or still, I can’t tell.

I’m reliably informed that Vinergy Resources (VIN.C) has dealt with its long qualifying transaction process, and will be un-halted soon – as in the next week or two. There’ll also likely be more transactions to speak of in quick time, as they haven’t been slacking while the stock has been untradable.

Vinergy has been halted since April.

CNRP Mining (CND.C) announced just after I posted the first versionof this article that it has completed due diligence on X-Sprays and will complete its RTO transaction with the company.

I like the X-Sprays story, its people, and its product, which I’m currently using to aid a full night of sleep. CBD-based SKUs have been developed, as have energy, libido, and more, and the plan is to sell them widely in retail outlets where allowed.

More in the days ahead, but the company will be closing its $3m public listing financing in a few days.

Speaking of rubes, numerous weed execs from Supreme, Hydropothecary, and Cronos got involved in a public Twitter spat with Organigram this week, which is notable as much for its comedy as its evidence that other LPs think the same way about Organigram’s tactics as I do.

I’ll just leave this here.

This is that point in a WWF match where all the owners and managers run into the ring pic.twitter.com/ZVMEYWLuqB

— David Brown (@drowbb) September 3, 2017

That’s a lot of stuff. You’re welcome. Now go get you some weed investments before the whole market takes off again.

— Chris Parry

FULL DISCLOSURE: Currently, Abcann, DOJA, Emblem, Lifestyle Delivery Systems, Quadron Cannatech, Invictus MD Strategies, Vinergy Resources, and Tinley are Equity.Guru marketing clients.

Ha, I see Emblem is no longer listed as a client. Whatever, you were totally justified in everything you said about their IR. They would get a better ROI on the money they are paying to Spinnaker if they used it to light their blunts.