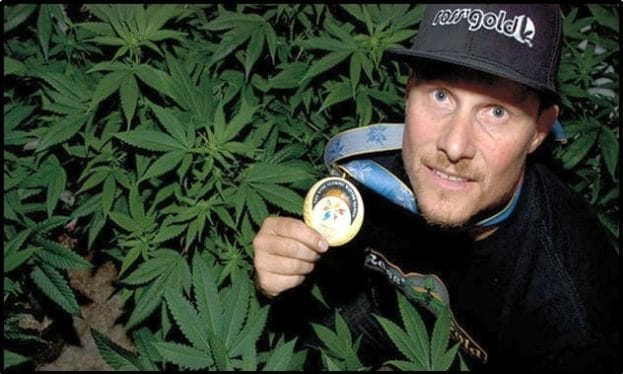

Olympic gold medal snowboarder Ross Rebagliati, 40, is fighting his ex-wife for joint custody of their toddler. Alexandra Rebagliati, 33 – a successful Kelowna real estate agent, accused Mr. Rebagliati of “smoking marijuana on a daily basis”.

To prove her point, the mother cut a lock of their son’s hair and sent it to a lab to be tested for “cannabinoids”. The lab confirmed the little boy had been exposed to 2nd hand cannabis smoke. No big surprise – Mr. Rebagliati was briefly stripped of his 1998 Winter Olympics gold medal after testing positive for marijuana.

Ms. Rebagliati’s end game is unclear. U.S academic studies have determined that marijuana use reduces violent crime and “produces net benefits for society.” While alcohol is a key predictor of child abuse – there is no established correlation between cannabis use and parental functioning.

The wonky thesis that pot-smoking makes you an unfit parent, highlights current investment opportunities in the cannabis sector.

There is a lot of smoke and confusion – but if you can see through it there is serious money to be made.

The most important investment advice we can give is to avoid companies whose future is entirely dependent on the outcome of a single marijuana production application.

Crude data-grinding confirms that most of these companies will not be successful. When the Canadian government says, “No” – you don’t want to be left holding that bag.

For those who think “bigger is better” there is the Horizons Marijuana Index ETF (HMMJ.T), with a market cap of $120 million, Aurora Cannabis (ACBFF.US) with a market cap of $715 million and Canopy Growth (WEED.T) with a market cap of $1.5 billion.

At Equity Guru, we recommend a more targeted approach. In our experience, investors can book big profits with small weed companies that have carved out clearly defined niches.

Here are five examples:

- Licensed Producers with a rapidly growing customer base.

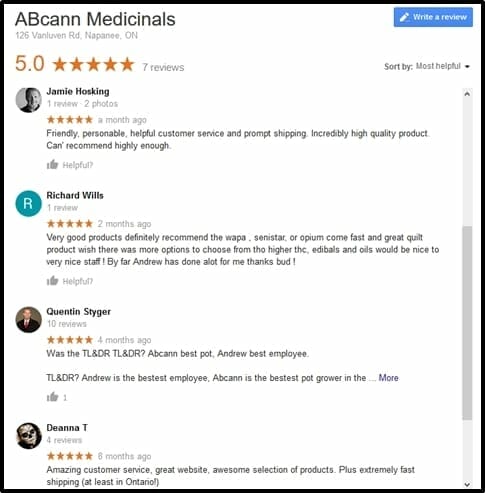

Example: ABcann Global (ABCN.V) is building a new 100,000-square-foot facility to boost their current 625 kilograms per year production. The company has heavy-weight financial partners.

ABCN operates under a climate controlled chamber, allowing it to produce a uniform product favoured by Health Canada during its randomized cannabis productions inspections.

A variety of THC and CBD levels give healthcare providers the best options for the treatment of ailments, such as: • Arthritis • Diabetes • Alcoholism • MS • Chronic pain • Schizophrenia • PTSD • Depression • Antibiotic-resistant infection • Epilepsy.

While many companies are waiting for the recreation market to book sales, ABcann already has a loyal customer base and it’s growing fast.

- Vertically integrated cultivation companies.

Example: Invictus MD (IMH.V) is focused on two verticals: 1. Cannabis cultivation in Canada under the ACMPR 2. Cannabis fertilizer and nutrients

IMH has been a premier manufacturer and distributor in the hydroponic and indoor growing industry for over 20 years.

“We have the largest land package in Canada for building cultivation facilities as demand increases and we will continue the disciplined but agile execution of our business strategy,” states Executive Chairman Dan Kriznic.

The Company has also committed $6 million from its treasury to building expansion at Acreage Pharms.

IMH has the ability to monetize its products at various points along the production chain and the company’s tentacles spread right across the nation.

- Cannabis Growers with Pharmaceutical divisions

Example: Emblem Cannabis (EMC.V) is a licensed producer in Canada, employing cutting-edge indoor growing technology. The company’s Ontario facility is designed to cultivate and cure cannabis.

In 2017 Emblem will begin construction on the first of three state-of-the-art 100,000 sq. ft. production facilities. Total aggregate production capacity is expected to exceed 70,000 kilograms per year.

Natural gas power systems will allow Emblem to disconnect from the electrical grid and become a low-cost “closed box” cannabis producer.

Health Canada has also given EMC the green-light to begin production of cannabis oil.

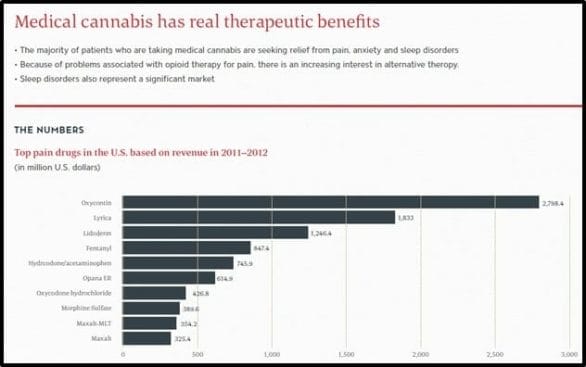

Emblem’s biggest differentiator is the separate pharma division and the associated development of cannabinoid medications. The massive, deadly, profitable opioid market is vulnerable to be disrupted. Emblem intends to be part of that disruption.

- New cannabis growers with strong branding DNA

Example: DOJA Cannabis Co. (DOJA.C) debuted as a public company on August 9, 2017. trading on the Canadian Securities Exchange (CSE).

The CEO Trent Kitsch is ballsy and brilliant. He built the legendary SAXX Underwear company from nothing – sold it – and turned his attention to weed. The Kitsch family also operates a wildly successful winery and high-end construction company in Kelowna.

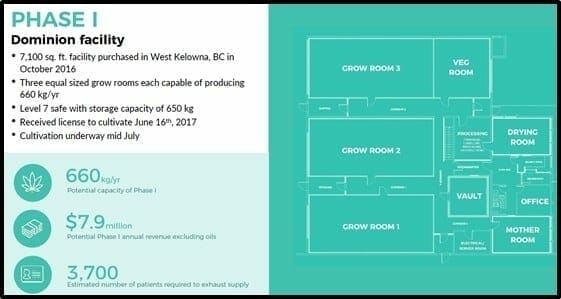

In October 2016 DOJA purchased the land for a 7,100-square foot commercial building in the Okanagan Valley. The company then began a Phase 1 build-out of the production facility capable of producing 660 kilograms ($7.9 million in sales) annually.

“As an authentic premium cannabis lifestyle brand, we have established deep roots locally,” confirmed Kitsch, “and we will take the brand beyond the Canadian border.”

Good branding means you don’t have to get into price wars with competitors, or buy TV ads or lease billboards to sell your weed.

- Cannabis companies harnessing mega-retail trends.

Example: Tinley Beverage Co. (TNY.C) is a marijuana beverage company that is taking an already habituated behavior (consuming beverages) and merging it into a frontier industry (cannabis) looking for new ideas.

Focused on the large California market, Tinley provides customers with the option to consume marijuana in a healthy liquid rather than the traditional method of inhaling it. Tinley’s production center is in Los Angeles.

THC beverages have higher margins than dried leaf products. Tinley’s THC products are packaged and marketed to appeal to alcohol drinkers.

Tinley’s other product, Hemplify, is a health drink containing industrial hemp with no trace of THC. In the last decade, companies like Coca-Cola (KO.NYSE) have seen a 20% decline in the sales of sugary sodas – as their market share has been eaten up by health drinks. So Tinley is, as they say, “on trend”.

_________________________________________________________________

The judge in the child custody case, ruled that Mr. Rebagliati is a “caring and capable father” and the ex-couple must share custody. He also admonished Ms. Rebagliati for “disruptive” outbursts in the court.

Sounds like she could’ve used some calming, locally grown medication.

Full Disclosure: Abcann Global, Invictus MD, Emblem Cannabis, DOJA and Tinley Beverage are Equity Guru marketing clients. Coca-Cola is not a client. We don’t traffic in poison.

NB: Doja Cannabis (“DOJA”) announced a name and symbol change on January 30th, 2018 as a result of its merger with TS Brandco Holdings Inc. (“Tokyo Smoke”). Effective 31 January 2018, the company trades as Hiku Brands under the ticker symbol HIKU.C