Editors Note:

We’ve asked Amos to expand his coverage of the ASX and provide a weekly column of what’s happening down under. Over to him.

Why the Cheetah?

Built for speed they are the fastest land animal on the planet. 0 to 60 MPH in 3 seconds. How’s your Ferrari doing again? They need to eat quickly to protect their kills from larger predators. Only half of their chases, which last up to a minute, are successful. They are solitary animals.

Can you see the similarities when applied to the markets?

We’re not here for shits and giggles. It’s about banking coin because you’re unlikely to get rich working for someone else. Walking away with a merit certificate for participating in the markets doesn’t help you – a quick look at the balance of your trading account always reveals the cold, hard reality.

We want to help you increase that balance by throwing some tips your way – costly lessons learned the hard way with real money on the battlefield of bids and offers.

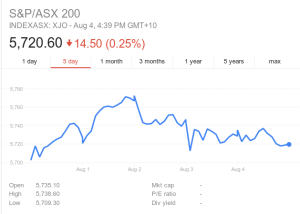

Ten second read

- The XJO will struggle against reporting headwinds for the remainder of August

- Coal rolls on despite disbelief

- We throw our hat into the ASX Sharemarket Game, looking to make some $$$ for charity

- 4 stocks to add to your watchlist: WHC.AX, RSG.AX, HVN.AX, GXY.AX

- Aristocrat Leisure (ALL.AX) jackpots back above $20

The week that was

Flew out the gates early in the week only to give most of it back over the remainder of the week. This is a pattern that plays out many times on the ASX. (Sometimes in reverse). The idea is to frustrate longs and shorts in equal measure.

Mon +23.3, Tue +51.8, Wed -28.2, Thu -9.1, Fri -14.5 for a total gain of 23.3 on the week. Bulls won’t be happy surely and 5800 looks unlikely to be exceeded in coming weeks.

The reasons? Reporting season, for one, the time when ASX companies are required to report their financials (that annoying twice yearly occurrence).

The other factor is the US markets, which are now in the red zone. If we can’t rally on the back of consecutive ATH’s on the DOW then heaven help us when some red starts flowing out of the states.

The S&P/ASX 200 (XJO) is Australia’s primary stock market index. The XJO struggles this time of year because it is unevenly weighted. The Top 50 stocks (which account for 63% to total market cap) have a huge impact on the index overall, and it only takes one or two of them to get smashed (after disappointing the market) to put a dent in the XJO for the day.

Take Wednesday last week when the market was disappointed with Rio’s (RIO.AX) earnings – which actually looked quite good. The 2.5% percent hit RIO took put paid to a green day there and then.

More on that – playing earnings is a mugs game. Why? It’s not the earnings that matter, it’s the market’s reaction to the earnings. Look at it this way – there are 4 possible outcomes and you’re betting on one so you only have 25% chance of being right!

The ASX Sharemarket Game – Week 1

Another player enters the arena. Welcome, EquityDotGuru!

We want the glory. The fame. Our name in lights. Simples.

Oh, and if we win any money then we’ll donate that to charity. Win – Win. And we will!

How it works

- AUD 50K to invest.

- No single stock can comprise more than 25% of portfolio value. (aka No Plonking)

- The competition lasts 15 weeks.

- There’s a limited list of stocks (about 200) in which you can invest your playbucks.

- Limited to 20 trades a day, and brokerage is levied at the rate of $20.00 where trade value <= $10,000.00, or 0.2% where trade value > $10,000.00.

- Trades placed match against what is in the real market.

The Strategy

- Half the battle is staying away from the stinkers. Banks, especially in light of the saga enveloping CBA in recent days, are out.

- Stay away from falling shares and turnaround stories, we’ve got 3 months, not 3 years.

- Think bullish(ly) – If the chart doesn’t talk to you in 3 seconds it never will.

- Don’t churn the account – a weekly rebalance every Friday is fine if required.

- Stay fully invested. Gotta be in it to win it. Sitting in cash is for pussies.

- Focus on stocks under 10 bucks.

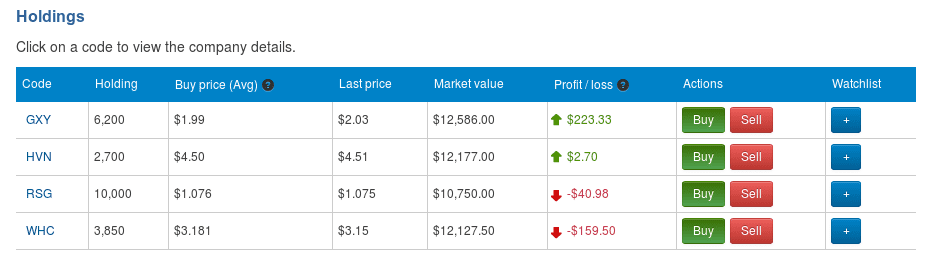

The portfolio

Thought about looking at 200 charts then quickly dismissed the idea. Hey hang on a minute – why not employ the basic themes we’ve been banging on about for the past 6 months here at Equity Guru?

Yeah, that’d work just fine.

- Galaxy Resources (GXY.AX)

My colleague Lukas Kane has been consistently pointing out that lithium-ion batteries are now in everything except Fidget spinners.

My colleague Lukas Kane has been consistently pointing out that lithium-ion batteries are now in everything except Fidget spinners. This is one theme that we’ve really tried to push in recent months and for good reason. The Cobalt / Lithium story makes sense and it’s easy to understand.

We all wish that the batteries in our smartphones lasted longer right?

We’d all feel better driving an Electric Vehicle (EV) than a gas guzzler, right?

Lithium is the metal of our time. The Connor McGregor of metals.

Galaxy Resources looks the goods. They own the Mt Cattlin Spodumene Mine near Ravensthorpe in Western Australia and the James Bay Lithium Pegmatite Project in Quebec, Canada.

Happy with the entry point and the trade has already moved in our favor. Sweet.

- Harvey Norman (HVN.AX)

A counter-intuitive trade. Bricks and mortar retail is dead and Amazon (AMZN.NASDAQ) is assembling its army as we speak to battle the remaining retailers left operating in Australia.

Feels good to break a rule now and then, doesn’t it?

Don’t underestimate Gerry Harvey. He could sell vacuum cleaners to Eskimos (probably has!).

The chart is whispering that something is brewing here and 5 bucks looks like the proverbial PTJ chip shot from here.

This one should rally into earnings if I’m right – Let’s hold it until then and re-visit.

- Resolute Mining (RSG.AX)

Resolute is a proven gold producer with operations in Australia and Africa.

Q: When did Noah build the ark?

Before the storm.

Golds time is coming and when the Gnomes of Zürich give their approval, things could heat up very quickly.

The first up-move in junior miners could be violent. Now is the time to get set.

Historically, the biggest gold investment returns have come from junior explorers or miners, building resources in mining-friendly jurisdictions with low labor costs.

We’re in with a full boat and the position will add some volatility to the portfolio 😉

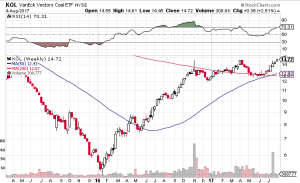

- Whitehaven Coal (WHC.AX)

Firstly, take a look at the chart on your right. That’s not Whitehaven, it’s the Coal ETF (KOL.NYSE) and as the weekly shows it’s just itching to move higher. See how the blue line is above the red one? Hasn’t happened for while right?

Worried about getting long here? Why?

Worried about getting long here? Why?

Ok, Imagine you’re Maverick sitting up front in the Tomcat. You’ve got missile-lock and even Jester want’s you to take the shot. But you can’t pull the trigger right? You say “It doesn’t look any good.”

I’m Goose sitting behind you screaming “Mav, it doesn’t get to look any better than this!

Regular readers will know this isn’t the first time we’ve mentioned coal. When we last highlighted the black death back in April, Whitehaven was sitting pretty much where it is today.

Here’s our thinking on this one: The earnings are going to impress on the back of a rising coal price. In turn, this will help WHC power through the $3.30 resistance that has held it back.

This is not the place to short – get long or stay clear.

Whitehaven Coal Limited will reveal its full year results on Thursday 17 August 2017.

Tip: Don’t do a ton of research and then impulsively buy something else on a whim. Stick to your guns!

Closed Trades

Had an in-and-out on Bellamy (BAL.AX). Read more articles through the week on cleanout-crews still working over supermarkets in search of the white gold. The chart showed me enough. Hopped on board but got cold feet when the trade went against me. Dumped it.

Tip: Listen to your gut. Don’t feel stupid for selling a stock soon after you buy it especially if there’s something you missed prior. Doesn’t matter if you’ve owned it for 10 minutes or 10 days.

Aristocrat Leisure (ALL.AX)

Stocks you’ve owned are a little like old flames. Some you look back on with great fondness, while there are those that send a chill down your spine and you never want to see again.

Luckily Aristocrat is in the former category for me, it was the very first stock I purchased in my own name. Remember giving the old man some money once to buy me some BHP shares, but he invested it at the dog track instead and lost.

Tasty Reuben never ran that well at Wentworth Park, come to think of it.

I’m glad to see that long term holders can finally pull those shares out of the bottom drawer and cash out near the previous peak, should they choose to do so.

–// Craig Amos

FULL DISCLOSURE: None of the stocks mentioned in this article are Equity Guru clients. The author wishes he still had his Aristocrat shares – he purchased them at around $3.50