FAANG stocks (Facebook, Amazon, Apple, Netflix and Google) have had a rough ride lately. In June all five closed down at least three percent on big volumes. Then came Amazon’s news on earnings last Thursday. Thomson Reuters had predicted AMZN’s earnings at $1.42/share, but came in at an astounding $0.40/share. It’s the biggest miss by the retail and media giant since 2011.

Jeff Bezos was briefly the world’s richest person, and this blip shows some Wall Street pundits are still his friends. One analyst is giving AMZN the benefit of the doubt on this one, especially given its status as one of the FAANG cornerstones. One cloud on the horizon is that, historically, when this happens and investors buy on the close before earnings are released and then sell the position at the close of the next trading day, the average loss is 2.9 percent (according to data analytics firm Kensho); Amazon finished down on Friday exactly 2.9 percent.

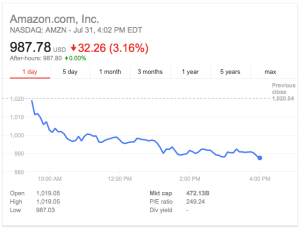

Howard Gold at MarketWatch was not hopeful in June for a recovery by the formerly fantastic five; a few days after that column, AMZN shelled out $13 billion in cash for the Whole Foods chain. Wall Street has pounded companies in the past who dared to spend, and AMZN is being lashed at the moment. From its five-day high of $1,081.61 at noon EDT on Thursday, the stock price been in a freefall which continued into Monday, wobbling well below the $1,000 barrier and closing at $987.78.

One observer thinks it could be a long road back for AMZN, while another researcher points out there is a difference between “expenses” and “investments.” One thing is clear: despite the knock AMZN has taken in the market, it is big enough and diversified enough to absorb the blow. The Whole Foods purchase shows the company is willing to open its wallet to get a high-profile chain in a business notorious for razor-thin margins, and is looking to diversify even more.