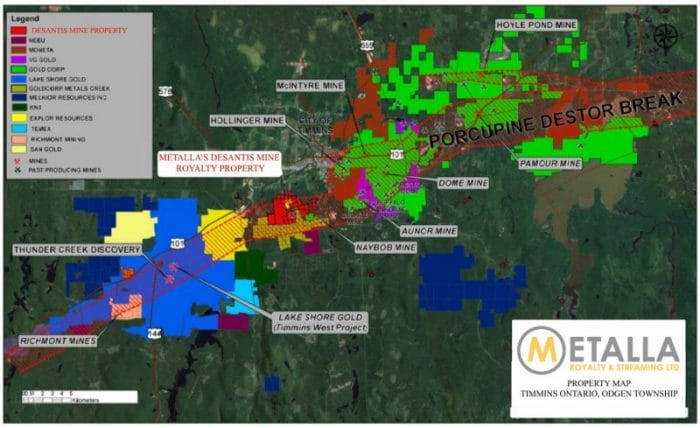

Metalla Royalty and Streaming (MTA.C)(“MTA”) significantly added to its streaming portfolio when the company announced closing its acquisition of the Hoyle Pond Extension royalties at the beginning of the month.

The royalties are located on claims beneath the Kidd metallurgical complex and along strike to the east and northeast of the Hoyle Pond Mine, which has produced more than 2.5 million ounces of gold since production began in 1985.

Hoyle Pond is part of Goldcorp’s Porcupine project in Timmins, Ontario, which has produced over 67 million ounces in the 107 years Porcupine has been in operation.

The area is prolific and Goldcorp is knee-deep.

So far, the major has drilled a total of 83,000 metres from surface and underground on the extension. Goldcorp also poured $194 million into the completed Hoyle Pond Deep Project to access and develop the lower levels on the extension.

Goldcorp is committed to mining every last ounce from Hoyle.

So, what’s this mean for MTA?

According to the news release, the royalty streaming company has locked into a 2% NSR agreement on Goldcorp’s Hoyle Pond Extension properties which include the Hoyle Pond Extension, the fee simple mining rights and the Colbert/Anglo Property mining rights located in Matheson township.

Hoyle Pond remains relatively rich, producing 160,000 ounces of gold annually at an average grade of 14 gpt.

These rights sit on top of the company’s agreement for the West Timmins extension properties. The West Timmins mine was snapped up Lake Shore Gold in 2016 and is the flagship operation for the miner in the district. The mine produces 50,000 ounces every year with an average grade of 4.5 gpt gold.

MTA has a 1.5% NSR on the West Timmins extension properties owned by Tahoe subject to a buyback of 0.75% for 750K.

Then there’s the DeSantis project, which includes the past producing DeSantis Mine which produced 35,800 ounces of gold during a sporadic period of production. Now the project is owned by Osisko and is located 11 kilometres west of Goldcorp’s Dome Mine and 14 kilometres east of Lake Shore Gold’s Timmins Mine.

MTA has a 1.5% NSR on DeSantis now owned by Osisko with a buyback of 0.5% for $1.0 million.

The NLGM Silver agreement is interesting as it involves the New Luika Gold Mine, located in the Chunya Administrative District, southwest Tanzania. NLGM lies in the second largest gold producing region in the country during the 1900s.

MTA snapped up 15% interest in Silverback Limited, a privately-held Guernsey-based investment firm which owns 100% of the NLGM silver stream. As such, Metalla receives 15% of the silver produced from the NLGM operation under the agreement. The silver is then bought at 10% of spot upon delivery (US$1.80 per ounce at US$18 silver).

Annual production sits between 80,000-90,000 ounces gold and 125,000-150,000 ounces of silver. The stream is set to continue through 2026.

This all sits atop a grab bag of various royalty deals within the Timmins region that sit in exploratory stages.

The company experienced a bump on the boards today, climbing 8.16% in late afternoon trading to sit at $0.53 per share. MTA currently has a $30.63 million-dollar market cap.

If the year so far is any indication of the company’s commitment to its mandate, investors may see an commensurate growth in shareholder value.

FULL DISCLOSURE: Metalla Royalty and Streaming is an EQUITY.GURU client.