Snap quiz: who knows what zinc is? No – too easy (it’s a metal).

Who knows what zinc does? Answer: it’s an anti-corrosive added to iron or steel to prevent rusting.

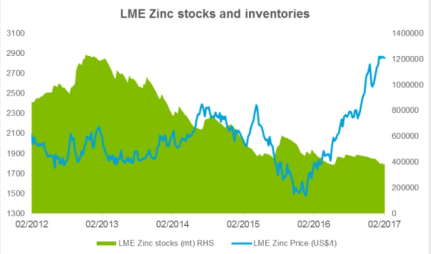

According to a report by the International Lead and Zinc Study Group (ILZSG) 2017 global demand for refined zinc rose 3.6% with mine output decreasing 1.2% – creating a 4.8% gap.

The Zinc ETF, (ZINC.L) tracks the Bloomberg Zinc Subindex. It is a good proxy for the overall direction of the zinc market.

Sometimes the raw data can fool you, but in this case there are numerous measurable metrics which reinforce the premise that there is a serious zinc deficit looming – and fortunes can be made if you know how to play it.

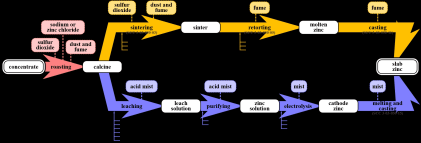

The “smelter treatment charge” is one such metric. Zinc miners pay a fee to convert zinc concentrates into pure zinc. It’s a tricky process because zinc has an unusually low boiling point (900° C, compared to 2,700° C for gold). If you make a mistake at the smelter the zinc can escape as a gas. The process looks roughly like this.

That’s bonus information for metallurgy nerds. The important takeaway for metal investors is that the 2017 benchmark smelter treatment charge is 30% lower than it was in 2015 ($172/tonne vs. $245/tonne).

There is so little zinc around that miners have been able to negotiate a 30% reduction in the cost of smelting – while eliminating “price participation” from the smelters.

The shortage of zinc has occurred because two of the world’s largest zinc mines have run out of ore (Australia’s Century mine, and the Lisheen mine in Ireland) as China shuttered 26 zinc mines in Hunan province due to serious environmental breaches.

Now we’re not zinc experts. Yet.

Although we haven’t studied every “zinc play” on the TSX.V, there’s one micro-cap zinc company we believe in. It’s called Zinc One (Z.V) and we’re bullish on this name because of the location (Peru) and the geology (extremely high grade) of their mineral deposits.

We also have a bit of inside information on this company. Well – not “inside” – but it’s information you might not have. You see, years ago, yours truly worked closely with the CEO, Jim Walchuk on another project.

Greed, self-importance and lack-of-focus are all flaws which can blind mining CEOs from time-to-time. Just ask Tom Albanese.

Jim Walchuk has none of these flaws. He’s a mining savant with over 37 years in the game – a rare CEO with strong scientific and financial credentials and 360° vision.

The former Mining Manager for Barrick at the Bulyanhulu Gold Mine in Tanzania, Walchuk built a high-grade underground mine and achieved 2 million man-hours without a lost-time accident.

That’s a remarkable statistic.

It demonstrates that Walchuk is an operational perfectionist who cares about every “actor” along the development chain from seed investors to tunnel diggers.

That may or may not be important to you. But we believe good ethics is good business. We want our partners to be smart, focused and gracious.

Acquisition provides Zinc One with highly strategic asset mix

Zinc One recently acquired the Bongará zinc-oxide deposit and the adjacent Charlotte Bongará zinc-oxide project in Peru from Forrester Metals.

For the first time, the two projects have been controlled by a single operator, creating the opportunity to prove up a substantial high-grade, zinc-oxide resource along a 4km-long trend.

The Bongará Zinc Mine was mined in 2007 and 2008 by open-pit methods. As you see below, it is a high-grade resource.

| HISTORICAL RESOURCE CATEGORY | MINERAL TYPE | TONNES | ZN (%) |

|---|---|---|---|

| Measured | Oxides | 329,236 | 22.45 |

| Indicated | Oxides | 678,560 | 21.2 |

| Total M + I | Oxides | 1,007,796 | 21.6 |

| Inferred | Oxides | 209,018 | 21.1 |

Source: https://www.zincone.com/projects/bongara-zinc-oxide-deposit/

A 60% Zinc calcine was sold to smelters/refineries in Peru and the United States. The mine was shut due to sinking zinc prices. That price trend is now at the beginning of a long-term reversal.

The Bongará Zinc Mine mineralization is concentrated along a 2.5 kilometer axis. Zinc One believes that this zinc-oxide mineralization continues into an additional exploration area known as Campo Cielo.

About two kilometers northwest – at the Charlotte Bongará Project – a previous mining company had near- surface drill intercepts that included 29.5% Zn across 15.5 meters, 26.1% Zn across 12.5 meters, 29.7% Zn across 11.5 meters.

Zinc One also controls a third asset: the Azulcolcha West zinc prospect located in central Peru. Over 8,000m of drilling has been completed on this project, with multiple additional targets.

Last week, Peru’s Energy and Mines Minister Gonzalo Tamayo stated that he anticipates, “the recovery of mining investment in 2018” and reminded a group of journalists that “Peru has been listed as Latin America’s most attractive mining country by Canada-based Fraser Institute – and we want to stay in that position.”

People, Politics and Prices are all favoring Zinc One.

The Peruvian developer is currently trading at .65 with a market cap of $36.6 million.

FULL DISCLOSURE: Zinc One is a new Equity Guru marketing client.