Trying to “Make America Great Again” by reviving the coal industry – is like trying to extinguish a house fire by spitting on it. If coal employment was restored to 2003 levels, there would still be more people working in car washes.

While the brain trust in Washington flaps its arms, China is opening its borders, doing deals and making money.

The Chinese “Belt and Road” Initiative is a trading strategy promoted by Chinese President Xi Jinping that focuses on expanding trade routes between China, Europe and Africa. It has two parts: the land-based “Silk Road Economic Belt” and the ocean-going: “Maritime Silk Road”.

The scope of the trading partnership is mind-boggling. It involves 65 countries, about 60% of the world’s population and 30% of the world’s GDP.

One country destined to benefit from “Belt and Road” is Sri Lanka. Just last month, Sri Lankan President Maithripala Sirisena, met with Yu Zhengsheng chairman of China’s CPPCC to advance the “China-Sri Lanka Strategic Cooperative Partnership”. China plans to spend $1.1 billion creating a “port city” in Sri Lanka’s Colombo.

Sri Lankans have a 94% literacy rate – and business is typically conducted in English. Sri Lanka’s top exports are currently tea and women’s underwear. Recently Hong Kong manufacturers have been diversifying their supply chain by establishing factories in Sri Lanka (which has lower labour costs).

As the “Belt and Road” initiative becomes a reality, Sri Lanka is positioned to become a financial and shipping center in the Indian Ocean. When that happens, some foresighted niche investors are going to make a lot of money.

But it won’t be by building more underwear factories. Or harvesting black tea.

Sri Lanka has something the world desperately needs: vein graphite.

In the late 1800s there were hundreds of graphite mines in Sri Lanka. During World War I, Sri Lanka exported 30,000 tonnes of graphite a year – supplying 30% of the global graphite demand.

Graphite is a key ingredient in Lithium-ion batteries. Demand is surging in 2017 partly because of the production of electric vehicles. China is forecast to have 5 million electric vehicles on the road by 2020 (a 500% increase).

Vein graphite is also required for brake and clutch applications. Commercial grades of vein graphite typically range from 80-99% carbon.

Sri Lanka has just three outdated graphite mines, producing high grade graphite using archaic technology.

Currently China is the world’s largest graphite supplier. But electric vehicles require premium grade large-flake graphite. There is very little of that in China. So they are looking elsewhere.

Sri Lanka has the world’s highest purity graphite. It is also a mature mining jurisdiction with streamlined permitting protocols. Are there investment opportunities here? Of course. Here’s one way to play it:

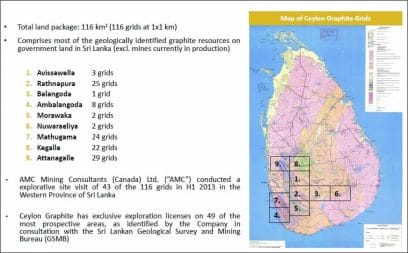

Ceylon Graphite (CYL.C) controls 116 graphite grids across Sri Lanka (each grid is one square kilometer). CYL management recently completed a trip to Sri Lanka, where they met with Sri Lankan government officials to discuss permitting and approval processes.

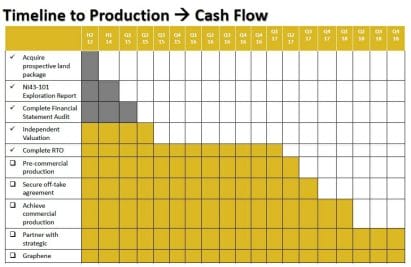

The timeline-to-production with vein graphite is surreally fast because of the ultra-low cost of building a mine (about $500,000). Ceylon could be in production by the end of 2017.

The company is purchasing a drill rig to explore its grids, while conducting detailed electromagnetic mapping. CYL’s goal is to build a geological database for future NI 43-101 resource estimation and to begin gathering bulk samples from grid sites.

CYL’s drill program is exploring for lower extensions of the surface graphite vein mineralization.

“Our first goal is to start commercial production of graphite in the foreseeable future,” stated Bharat Parashar, CEO, “and then provide consistent quality and volume of the product.”

“Our first goal is to start commercial production of graphite in the foreseeable future,” stated Bharat Parashar, CEO, “and then provide consistent quality and volume of the product.”

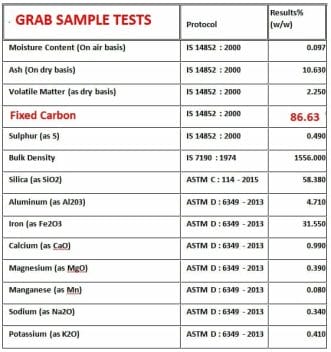

On May 2, 2017 Ceylon announced lab results from a 1.1 kg grab sample of historic dump material from its K1 site in Karasnagala. The K1 site was selected for its historic crystalline graphite production and the fact that it contains numerous of abandoned mine shafts.

“Having 86% Fixed Carbon is a fabulous result from weathered surface dump material,” stated Parashar, “These results have validated our hypothesis that the K1 site has high purity graphite.”

“Having 86% Fixed Carbon is a fabulous result from weathered surface dump material,” stated Parashar, “These results have validated our hypothesis that the K1 site has high purity graphite.”

Drilling is expected to reveal non weathered graphite that will be significantly higher quality than the grab sample.

Now let’s be honest, getting excited about a “grab sample” is like walking into a restaurant kitchen, dipping your finger randomly into a simmering pot, licking it, and then declaring, “OMG –dinner is going to be…delicious!”

The reality is, dinner might be served late – too salty – or burned. But mitigating these risks: CYL’s kitchen has a 5-star chef. The President and CEO Bharat Parashar is a heavyweight: 36 years of deal making in South Asia – raising over $8 billion through debt and equity transactions.

Ceylon Graphite is sitting in a triangle of good macro-news: 1: Strengthening global trade partnerships 2. Surging graphite demand and 3. Big deposits of rare large-flake graphite.

A recent report by Allied Market Research predicts that the global graphite market will increase 44% in the next 7 years from $13 billion to $18.8 billion.

CYL is trading at .27 with a market cap of only $15 million, so it’s a baby, with a lot of room to grow.

— Lukas Kane

FULL DISCLOSURE: Ceylon Graphite is an Equity.Guru marketing client