SOP potash is often lumped into the general category of “fertilisers” with its poorer, less talented cousin – MOP potash.

To illustrate the gravity of this error, imagine SOP is the Grammy Award winning Cellist, Yo-Yo Ma who guest-stars with the New York Philharmonic at Carnegie Hall.

Now imagine MOP is an older sibling who plays Kazoo versions of Living On a Prayer in the washroom of the local legion.

Would you have the audacity to walk up to Yo-Yo and say, “I hear you and your brother are both energetic live performers”?

That’s how ignorant it is, to group SOP and MOP together.

Ninety percent of the global market is dominated by Muriate of Potash (MOP). This market is about 55 million tonnes per year. The high chloride content in MOP can damage fruit and vegetables crops.

There is lots of it, and it’s cheap.

Sulfate of potash (SOP) is premium fertilizer with annual demand of 6 million tonnes per year. It is used to boost production of high-value crops including tomatoes, spinach, carrots, cucumber, tobacco, strawberries, avocados etc.

There’s less of it, and it’s about 300% more expensive.

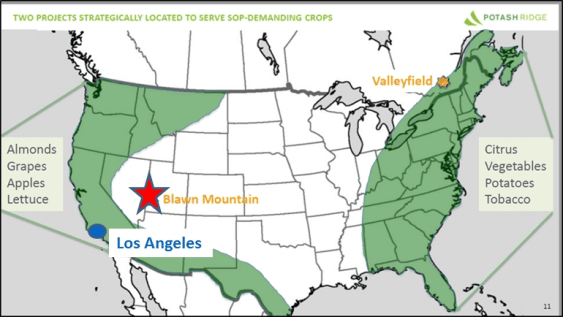

Potash Ridge’s (PRK.T) is determined to become a premier producer of SOP in North America. The company owns two SOP projects: the Valleyfield Project in Quebec, Canada, and the Blawn Mountain Project in Utah, USA.

Today I want to talk about the Blawn Mountain project because they just found something quite astonishing (and valuable) in their garbage.

Before we get into that, let’s review: PRK’s 43-101 Blawn Mountain Technical Report anticipates a surface mine with conventional crushing, roasting and leaching.

The proven and probable mineral reserves of 153 million tons support a 46-year project life. PRK aims to be the lowest cost producer of potassium sulphate in North America with net cash operating costs of $172/ton.

Blawn Mountain is expected to deliver an after tax internal rate of return of 20.1%, based on assumed price of $675/ton for SOP.

After tax cash flow is projected to be $107 million per annum during first 10 years of operation after ramp-up; life of mine average of $128 million per annum.

I’m not a Financial Analyst, but those numbers look good enough to take to the bank.

But here’s the thing. The numbers just got better.

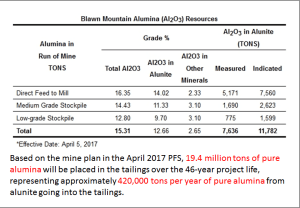

On April 19, 2017 PRK published an update to its Prefeasibility Technical Report – which assumed the production of 232,000 tons per year of SOP together with by-products of sulphuric and alunite reserves.

The alumina-rich material was assumed to go into the “tailings” aka: the garbage.

Since then, further scientific studies have revealed significant commercial value in the alumina-rich tailings.

The United States Geological Survey reports that in 2015, processed alumina sold for US$410 per ton.

Let’s say PRK was getting only half that (US$200 per ton), the alumina (which was going to be chucked out in the garbage) will generate $84 million a year in sales.

Yes, that’s sales…not profits…and the PRK press release contains the following sobering warning:

So let’s not get too excited.

Or should we?

The point is, a bright project just got incandescent. As so often happens in the mining industry, the news was buried in a press release beneath technical terms that would confound most retail investors.

The alumina-rich residue material has multiple industrial applications, including catalysts, electrical insulators, thermal sensors, grinding media and fast-growing applications in the pharmaceutical industry.

The Blawn Mountain Project is strategically located to supply alumina to the pharmaceutical industry.

Seattle and San Diego are big pharmaceutical hubs while Los Angles headquarters more than 100 pharmaceutical companies, generating tens of billions of dollars in sales.

Potash Ridge is conducting additional metallurgical testing to determine the most profitable method of extracting alumina from the tailings.

“Blawn Mountain is already a world-class SOP fertilizer project, with a long project life and very low operating costs,” stated Guy Bentinck, the Corporation’s CEO. “The realization of market demand for the alumina contained in our tailings provides tremendous value upside potential and diversity to our revenue stream.”

Exactly.

So let’s remember: the A-plot here is fertiliser. PRK intends to make sure we never run out of Guacamole or strawberry ice-cream.

But if you’re rummaging through your garbage and you discover an $84 million/year revenue stream – that’s not a bad thing. It can shift mine economics from “good” to “sexy”.

That should be music to PRK shareholders.

And yes – that’s cello – not the kazoo.

[Editor’s note: PRK currently trades at .22 with a market cap of $28.5 million.]

— Lukas Kane

FULL DISCLOSURE: Potash Ridge is an EQUITY.GURU marketing client.