Stepping Up to the Plate with the Lithium Big Boys

As the name suggests, LiCo Energy’s mission and goal is to create a modern and environmentally conscious world, done through the development of lithium and cobalt projects.

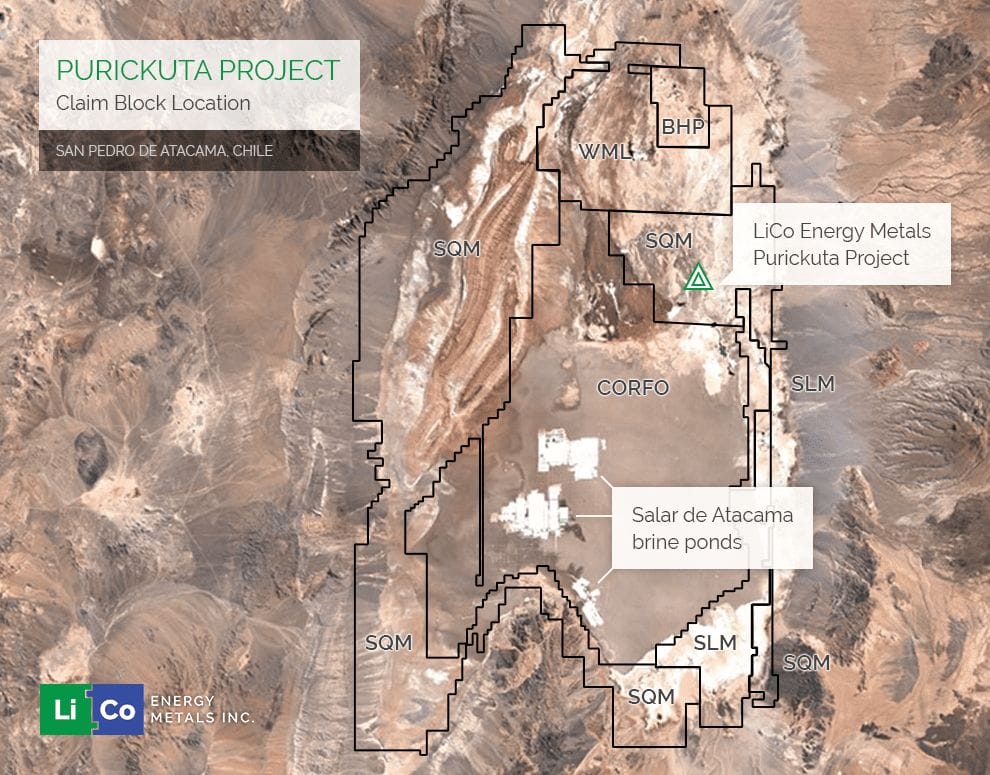

On January 3, 2017, LiCo made the transformational announcement of signing an LOI with Durus Copper Chile SPA of Santiago, Chile, whereby LiCo can earn up to a 60% interest in the Purickuta lithium exploitation concession, located in Chile’s Salar de Atacama.

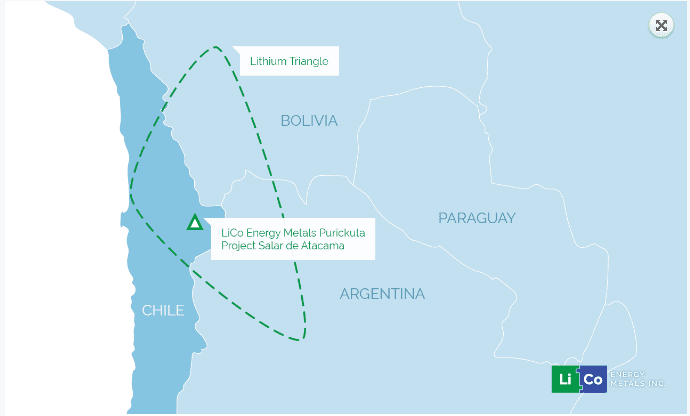

As depicted, LiCo’s acquisition is nestled in a hotbed of lithium activity, in an area that is home to the world’s highest grades, and 37% of the global lithium output from two facilities operated by Sociedad Quimica y Minera (SQM, Mkt Cap: US$8.5 billion) and Albemarle Corporation (ALB, Mkt Cap: US$10.6 billion).

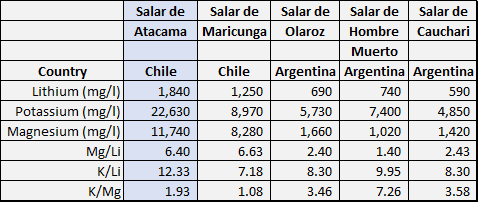

The grades in Atacama are second to none – the environmental conditions are near perfect for lithium, with high evaporation rates of 3,200mm per year and low rainfall levels of 15mm per year. These conditions make the Atacama the easiest and cheapest area to produce lithium in the world.

The grades in Atacama are second to none – the environmental conditions are near perfect for lithium, with high evaporation rates of 3,200mm per year and low rainfall levels of 15mm per year. These conditions make the Atacama the easiest and cheapest area to produce lithium in the world.

(The Lithium Triangle, source: corporate website)

(The Lithium Triangle, source: corporate website)

The Purickuta Project is 160 hectares and is just one of a few ‘exploitation concessions’ that have been granted. Purickuta is located within an existing exploitation concession owned by SQM, and is located 3 kilometres north of CORFO’s exploitation concession, and 22 kilometres northwest of both SQM and Albemarle’s facilities within the CORFO concession. These facilities produce over 62,000 tonnes of lithium carbonate equivalent annually, and account for 100% of Chile’s current lithium output.

(The road to Purickuta, source: corporate website)

(The road to Purickuta, source: corporate website)

Per the letter, LiCo will make cash payments of US$8.4 million and issue five million shares over certain work commitments. These milestones include, completion of an NI 43-101-compliant report; preliminary economic assessment; feasibility study; and the procedure and application for the execution of the special lithium operation contract.

The cost of a resource will be inexpensive. Due to the geology, this will require simple sampling and geophysics, and three wells and three monitoring wells, something we estimate will cost around $800,000. LiCo has ~C$1.8 million in cash right now – enough for the initial payments and exploration work.

Purickuta will contain a low-cost resource and will be a near-term production play. Within the Salar de Atacama, the lithium brines exist within 140 feet of surface, which means low exploration and extraction costs. Furthermore, the acreage is located near existing infrastructure, including pumps, solar evaporation installations, and labour.

This is a game-changing acquisition and will be the source of many catalyst moving forward.

Cobalt Heating Up

Since then, cobalt has been on a tear.

In just two months, the ‘blue metal’ is up over 30%! According to our analysis, it will at least double in the next five years, probably a lot sooner. The fundamentals are all there, yet there are only handful companies that offer meaningful exposure.

LiCo Energy is one cobalt company that is leveraged to the coming bull. The company owns the option to acquire up to a 100% interest in the Teledyne Cobalt property. This project is located in the famous Cobalt camp and is one of the highest-grade cobalt projects in the world.

Teledyne is on-strike with the Agaunico Mine, the area’s most renowned past-producing cobalt mine. The project is fast-tracked to production, with already $25 million (inflation-adjusted) of work completed, including a development ramp and a modern adit.

LiCo has already begun an exploration program, including line cutting followed by a geophysical survey. This work, along with historical data compilation, will be evaluated to advance a diamond drill program for Q1 of 2017.

LiCo Energy is emerging as the go-to energy metals play, with enormous potential in both lithium and cobalt. And there is no doubt that things are just warming up for both commodities. In Chile, a Chinese and Korean group are in advanced talks with the government to construct up a $2 billion mega-lithium batteries plant; the majors are jockeying hard for a position in the value chain. Also, the price of cobalt is now at a five-year high. We believe this is just the beginning as the world continues its quest for efficiency and sustainability.

FULL DISCLOSURE: LiCo Energy Metals is an Equity.Guru marketing client.

Palisade Global Investments Limited holds shares of LiCo Energy. Palisade Global Investments also owns a significant amount of Palisade Resources, the company LiCo Energy optioned the Teledyne Project from. Needless to say, we stand to benefit greatly from any volume this write-up may generate more ways than one. Furthermore, we receive either monetary or securities compensation for our services. The information contained in such write-ups is not intended as individual investment advice and is not designed to meet your personal financial situation. Information contained in this report is obtained from sources we believe to be reliable, but its accuracy cannot be guaranteed. The opinions expressed in this report are those of Palisade Global Investments and are subject to change without notice. The information in this report may become outdated and there is no obligation to update any such information. We highly recommend you do your own due diligence.