A week ago, when I hosted a Cambridge House Vancouver Resource Investment Conference panel on the lithium business, you couldn’t get a seat at the event for love or money. They were crammed into the back of the room and beyond, to see execs from companies like Lithium-X, Neo Lithium, Millenial Lithium, and Iconic Minerals talk about what’s next.

But first we had to talk about what’s now. And that involved a simple question that the crowd nodded along to, as one; Does the average lithium investor know what the hell he or she is investing in?

In a nutshell? The answer was ‘no.’ They have no clue. You have no clue.

Do you know the difference between brine lithium and clay? Do you know the current state of water rights complaints in the Clayton Valley? Is the global lithium supply meeting demand, and can the large long term players just turn on a spigot when more is needed?

These are not questions asked by gold investors, or tech investors, or weed investors. Most of those know the lay of the land in the business they’re buying into. But lithium, and the other energy metals that make up the contents of a lithium-ion battery, still come from a place of dark mystery for many.

We’re planning to answer a lot of these questions for you going forward, and have brought on one of the resource industry’s most bombastic voices in Bob Beaty to help lead you through it.

Bob’s going to be taking the Equity.Guru pole axe to a variety of energy metals plays, to see which can stand up to scrutiny. While he sharpens his shiv, we figured it would be worthwhile taking a broad view of the industry, to see what’s in a lithium ion battery, and who might be good value in the race to supply those elements.

This is not an exhaustive list of who’s who in the space, rather it’s a sample bag of what you might find if you go digging. Some are closer to production than others, some are testing the technological limits and innovating hard, some are straight up shopping and taking advantage of a surging market to make deals. There’s no right or wrong, there’s just what flava you like best.

LITHIUM:

http://gty.im/95592973

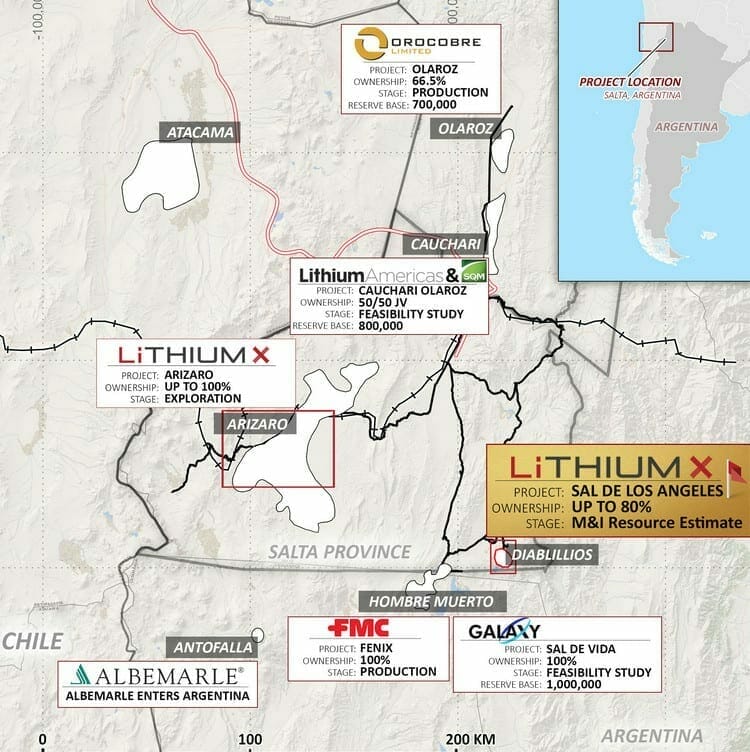

Obviously, when folks think of lithium-ion batteries, lithium is the first energy metal (or, rather, chemical) they think of. That’s what was behind the massive jump of Lithium-X (LIX.V) earlier in 2016 from Frank Giustra-connected microcap to seriously stomping midcap, with properties on two continents.

If you buy it: You’re buying three projects, two in Argentina, one in Nevada’s Clayton Valley, all of them spitting distance from the world’s largest existing producers.

Here’s what it looks like when you open a hole looking for lithium:

Mm… briny!

Now, Argentina is part of what’s known as the ‘lithium triangle’ (along with Bolivia and Chile), where most of the world’s lithium comes from. LIX started the lithium world buzzing when it launched into the Nevada Clayton Valley with two land claims around the existing Albermarle operation (long pumping out some of the most plentiful lithium resources in the world), but the Clayton quickly filled with me-too companies, and an existing spat over water rights has that part of the world on ice.

So LIX went south to Argentina, which loves a mine and offers cheaper operating, plentiful infrastructure and a low-cost currency. LIX is still closely watched and wants to be producing quickly. But while it’s a nice set-up with good genes and solid management and plentiful access to cash, it’s not a cheap stock. So the market has done a lot of looking about for someone who is.

Southern Lithium (SNL.V) is. For a reason.

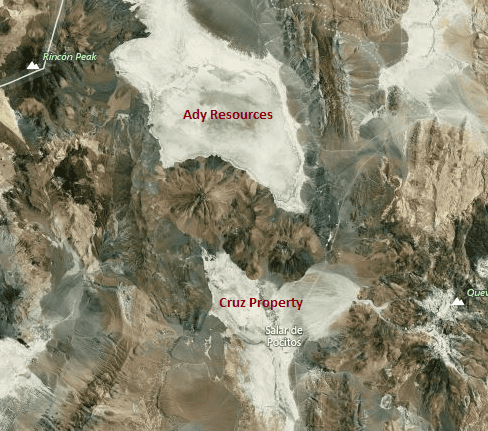

If you buy it: You’re buying into three claims, one in BC that is fine and okay but nobody is really talking about, another in Nevada that was a nice start, being as it’s on the border of Pure Energy’s (PE.V) existing claim but, you know, Clayton Valley and all, but the last one is the kicker. We’ve called it the lithium taint.

That Ady Resources blotch up top? That’s an existing project that has had upwards of $400 million spent on developing it because it has beau coup lithium. Right underneath that, the puckering hole there – that’s a volcano. When a volcano pushes through the rock, it generally provides the conditions for lithium to be gathered. Which is why Ady is running right up the side of it.

The other side, right under the pucker? That’s Southern Lithium’s Cruz Property. It’s early, it’s undeveloped, and they got it cheap. But as soon as they did, their neighbours to the north came knocking, asking if they’d like to give it over.

Suffice to say, they do not want to do this. Drilling results will, in all likelihood, reveal some lithium. How much is the difference between SNL being a solid return based on a likely flip, or a ridiculous return based on many M’s and dollar signs.

All of that said, when you buy it, you’re buying this:

Not much to look at. But that’s why lithium is such a mystery to many. SNL is waiting for drilling permits to get started on its first look.

The confusion over what lithium projects are, and how they differ, and what’s needed to get the lithium out of the ground, can be seen in concentrated form in one of the projects owned by Alix Resources (AIX.V).

The Cross Lake Property was explored from the late 1970’s to 1981 by the Tantalum Mining Corporation of Canada Limited (“TANCO”). The Company discovered tantalum (Ta) and niobium (Nb) oxide mineralization in granitic pegmatites. TANCO, was the operator of the Tanco mine, located at Bernic Lake, in southeastern Manitoba (now owned by Cabot Corporation), which was North America’s largest producer of spodumene, tantalum and cesium.

Maybe you’re smarter than me and understand what all of the metals mentioned above are good for. But I had to look shit up.

Tantalum is a chemical element with symbol Ta and atomic number 73. Previously known as tantalium, its name comes from Tantalus, a villain from Greek mythology. Tantalum is a rare, hard, blue-gray, lustrous transition metal that is highly corrosion-resistant. It is part of the refractory metals group, which are widely used as minor components in alloys. The chemical inertness of tantalum makes it a valuable substance for laboratory equipment and a substitute for platinum. Its main use today is in tantalum capacitors in electronic equipment such as mobile phones, DVD players, video game systems and computers.

Got it. Next.

Niobium, formerly columbium, is a chemical element with symbol Nb (formerly Cb) and atomic number 41. It is a soft, grey, ductile transition metal, which is often found in the pyrochlore mineral, the main commercial source for niobium, and columbite. The name comes from Greek mythology: Niobe, daughter of Tantalus since it is so similar to tantalum. Niobium is used in various superconducting materials. These superconducting alloys, also containing titanium and tin, are widely used in the superconducting magnets of MRI scanners. Other applications of niobium include welding, nuclear industries, electronics, optics, numismatics, and jewelry.

Go.

Spodumene is a pyroxene mineral consisting of lithium aluminium inosilicate, LiAl(SiO3)2, and is a source of lithium. It occurs as colorless to yellowish, purplish, or lilac kunzite, yellowish-green or emerald-green hiddenite, prismatic crystals, often of great size.

Check.

Cesium is a chemical element with symbol Cs and atomic number 55. It is a soft, silvery-gold (or, according to some, silver/colorless) alkali metal with a melting point of 28.5 °C (83.3 °F), which makes it one of only five elemental metals that are liquid at or near room temperature. Cesium has been widely used in highly accurate atomic clocks. Since the 1990s, the largest application of the element has been as caesium formate for drilling fluids, but it has a range of applications in the production of electricity, in electronics, and in chemistry.

So here’s one piece of lithium plot and, within it, you’ve got all sorts of energy metals, chemicals, and elements that can be used in everything from electronics to atomic clocks to batteries to laptop circuits. It’s like a big grab bag of techno metals.

But the spodumene is the key, and that’s where you’ll get clay-based lithium that isn’t cheap to process but at today’s prices, that doesn’t matter much. Lithium is gotten at in spodumene using an acid process, and the lithium within is used in auto batteries, ceramics, mobile phones and medicines.

Folks like spodumene because it comes in big ass chunks. Alix likes it because they have a bunch, and three other lithium projects besides – all for the bargain price of just $3.7 million in market cap.

Back to the Clayton Valley, I talked last week to Kit Nathe, who is in corporate development at Iconic Minerals (ICM.V). This is very easy to do, because Kit is whip smart, very experienced in her field, and is not a middle-aged white man in a Men’s Warehouse 2-for-1 suit.

She pointed out that Iconic fell almost bass ackwards into lithium, being as it was entrenched in Nevada’s gold scene, with three projects being explored, when it became clear that there was lithium in them thar’ hills and that maybe they should go get some.

The gold is great in and of itself, with historic resources and a potential million oz in their flagship property, but the lithium is what’s making their tires squeal. The plan is to spin out the gold properties to unlock the value in the lithium play, so if you buy into them today, you’re going to get shares in multiple companies going forward.

The lithium side is interesting, in that the whole water rights thing in the Clayton doesn’t effect them, on any of their three lithium properties. That is, while everyone in the Clayton is fighting over who can take water out of the aquifer, the Iconic property is actually located in the next county, and private water rights are uber available.

The kicker here beyond that little twist is that Iconic thinks they’ve found a way to draw more lithium out of their property through some experimentation they’ve done with heap leaching, that’s bringing them hand-wringingly good results. They expect an NI 43-101 resource to be completed within six months.

None of this is reflected in Iconic’s share price, which rose over $0.40 during the peak lithium craze last year, but sits at $0.10 today, which means for $6 million in market cap, you get three gold properties and three lithium plops in the deal, which is CRAZY undervalued.

Scientific Metals (STM.V) is a lithium play that saw an opportunity in cobalt, and has quietly set up to make a run at that space, announcing a $2 million financing a few days ago in combination with a 4-to-1 share rollback that took it from 120 million shares out to a much more pleasant 30 million. The problem with Scientific has been its reluctance to talk to the market about its plans, but it’s getting there.

If you’ve never seen an NI 43-101 before and don’t know what this inside baseball jargon is, let’s shift into real talk mode.

<realtalk>

Back in the day, a bunch of Vancouver sharks sold a bunch of investors who should know better the idea that they had stumbled upon a gigantic world-ending mountain of gold in Asia. Shares went to nutso billions huge before a geologist fell out of a helicopter and it came out that someone had salted the core samples with jewelry to make them look golderiffic, and shares dumped back to zero and the world said, “WTF Vancouver?!”, so the regulators put in place a rule that says you can’t say you have diddly metal in the ground unless you’ve done some serious ass research with a qualified third party.

This is an NI 43-101. [pdf-embedder url=”https://e4njohordzs.exactdn.com/wp-content/uploads/2017/02/Iron-Creek-43-101-Jan-12-2017.pdf” title=”iron-creek-43-101-jan-12-2017″] They make for terrible bed time reading but, if you force yourself, you find some interesting shit within. Go ahead and read through Scientific’s recent one (which says, hey, the last several owners of this property were dingbats who didn’t keep good records but they figured there was a bunch of cobalt here back when nobody gave a rat’s ass about cobalt), to see what sort of data goes into them, to get an accurate read on what’s coming out if anyone starts digging. It’s an education you should have, and this one shows how the process has changed over the years.

</realtalk>

What I like about the STM cobalt deal is, the reason this property was started and dropped by so many miners over the last several decades was because they were after copper, which you often find alongside cobalt. The thing is, the cobalt has traditionally been viewed as an impediment to getting to all that tasty future electrical wire, so a cobalt rich deal with shitty copper numbers has never been sought after – until now.

The lithium end of STM? Well, in the same style as their cobalt play, they’re looking at old oil wells in which lithium presence was traditionally seen as an annoyance by folks who wanted all that fat drippy oil and thought lithium was for emo teenagers with depression issues. They’re more excited by cobalt, as am I.

COBALT:

http://gty.im/516808190

Why cobalt? Well, your lithium-ion battery needs cobalt in the cathodes to work properly. As goes lithium, so too goes cobalt, so recently we’ve seen a lot of cobalt companies popping up, and even lithium companies which have decided to expand their horizons.

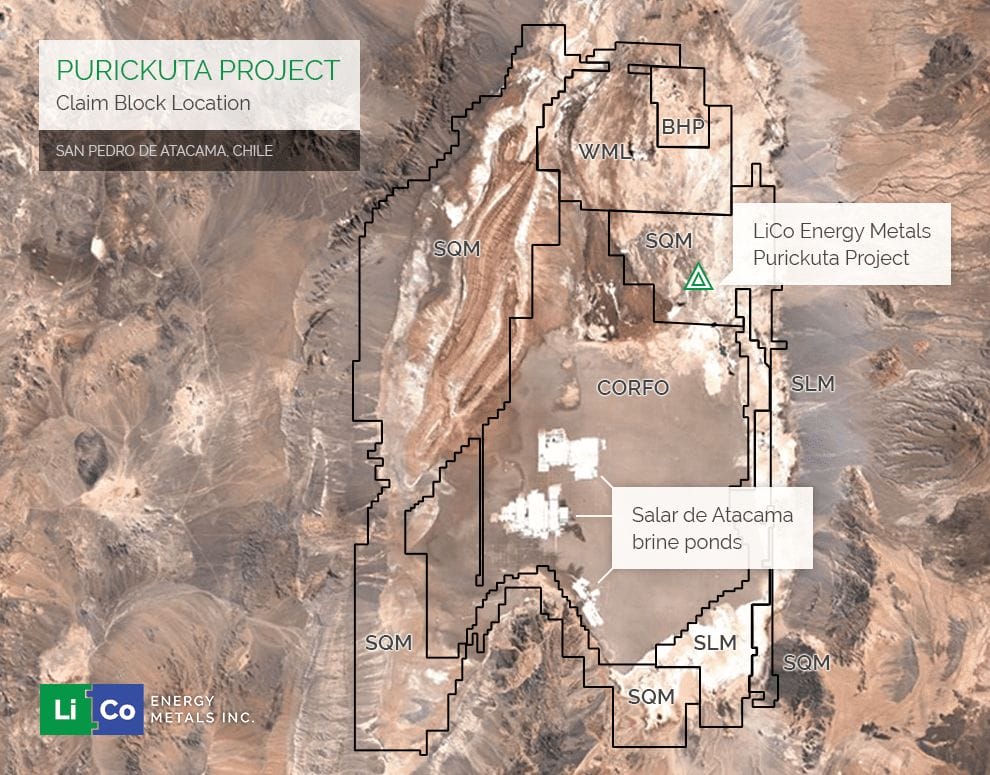

One of these is LiCo Energy Metals (LIC.V).

LiCo has a lithium project, and it likes it plenty.

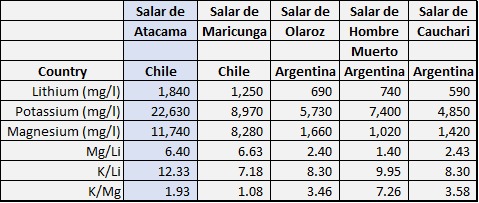

How does a $0.17 cent company acquire a lithium property in the Atacama Salar in Chile that sits within the property boundary of one of the largest lithium produces on the planet, and in a region which produces 37% of the world’s lithium needs?

My educated guess is that it’s not what you know but whom you know. Management at LiCo appear to have some decent contacts. The Purickuta property lies smack dab within the main asset of Sociedad Química y Minera de Chile S.A.’s property (SQM:NYSE). It is my guess that someone at SQM is more than pissed that a little gnat from Vancouver is sitting in the middle of their brine pond.

It wasn’t cheap to get there, but then it shouldn’t be, because this is lithium central. This is where lithium is pulled from the ground and ends up in your cellphone. When Elon Musk builds a giganto-battery the size of a shopping mall that turns California’s wind turbines into projects able to store energy when the wind is blowing, and draw from it when the wind is gone, the means to do it will come from the Sala de Atacama.

It’s going to cost LiCo $8.4 million to take 60% of this play. plus shares and money spent developing it out. In the meantime, China cash is pouring in, in an effort buy a chunk of SQM, according to reports.

LiCo has made some decent announcements to strengthen its management team, including the addition of Marcela Matus Hernandez, a chemical engineer with more than 15 years of experience in mining and chemical processes. Her professional achievements include conceptual engineering, control of chemical processes, development and implementation of pilot testing of research projects, and study and characterization of mineral ores. From 2008 to 2015 she held the position of director of research and processes for SQM Chile, leading a staff of 16. So she knows the area and she knows the neighbours.

LiCo, as can be determined from it’s name (with Li being the periodic symbol for lithium and Co being the symbol for cobalt), also has a cobalt play.

In fact, it’s located near the town of Cobalt, Ontario.

Most cobalt, as mentioned, comes as a by-product of copper mining. In Cobalt, Ontario, it comes alongside silver. Also, it comes without hideous human cost, which is what you get with most cobalt-primary mining in the world today.

Over in the Democratic Republic of the Congo, cobalt mining comes by virtue of kids poking the walls of deep dark holes with sticks and spoons. The ore is taken to Chinese agents who pay pennies on the dollar and send it all back home to be processed and turned into Samsung phones which, you may have heard, duly explode in your hands.

‘Blood cobalt’ is a terrible thing, and a thing that you and I indirectly finance when we buy our electronics from almost every supplier, because THERE’S NO COBALT SUPPLY IN NORTH AMERICA.

LiCo aims to change that up, and its cobalt property is right there where $25 million of inflation-adjusted money has been spent previously building ramps and a modern adit that rolls 500 feet parallel to the vein.

Mining has been engaged in at that location since 1903, and some 14 million kilos of cobalt have already been extracted there, to get at the 18 million kilos of silver behind it.

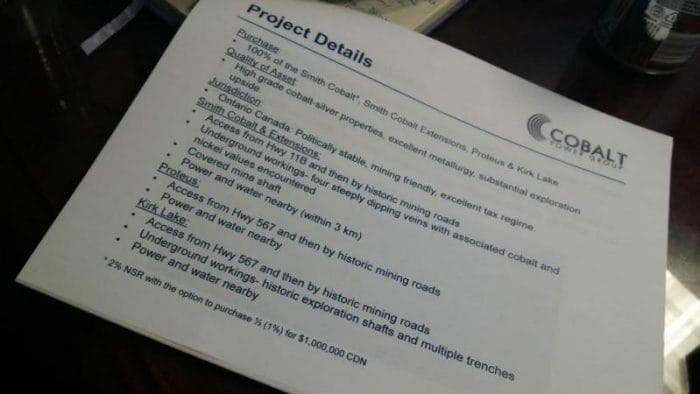

Also in the area of Cobalt, Ontario is Cobalt Power Group (CPO:V).

You might not have heard of this nerd-friendly ticker symbol, but you will. It shares many of those same selling points as the LiCo cobalt play, most of which I’m not going to type out here, because I am lazy. So instead I took a picture.

The big kicker? Market cap under $3m. Find me another cobalt play under $3m.

The bigger kicker? A gold project left over from a previous incarnation, and a graphite project that may come in handy as graphite is also important for lithium-ion batteries. Either way, well worth the price.

Also in the cobalt game is a company that pioneered the market trend late last year. Cruz Capital (CUZ.V) earned an eyebrow raise when execs rolled it forward – not back – to bring its price down from $0.66 to $0.22 – a speculator’s dream. Cruz stacked a boatload of cobalt deals when nobody gave a damn about the metal, front running the whole industry. In fact, Scientific Metals bought their cobalt play from Cruz, which now owns a stack of STM stock as a result.

It would be silly to go into detail about Cruz’s assets because they’re plentiful and all over the place in terms of advancement. Some are bits of ground you’d need to start from scratch with, some are historic assets with data included. Basically, if you want a cobalt play to take advantage of a hot market, Cruz is on your speed dial. Stock has been moving of late, from $0.11 in late December to $0.195 today.

GRAPHITE:

http://gty.im/73780943

Elon Musk has said, and I’m paraphrasing here, that you should probably call them graphite-ion batteries, because there’s more graphite in the things than anything else. And he’s right.

Before anyone gave a toss about lithium, graphite deals were abundant and plentiful, and much the same as many investors don’t understand lithium, they really didn’t get graphite.

Tennis racquets? Pencils? Lubricants? Nuclear reactor shielding? If you can tell me what the ore in your average graphite project is good for as an end use, you’re doing better than many graphite company CEO’s I’ve asked the question of.

I’m only going to talk about two graphite plays, because they’re very big and very different. The first is Graphite One (GPH.V).

I wrote about this company extensively a few days ago just as their PEA came out pointing to $1 billion worth of graphite being there, of a type that lab guys had to re-test a few times because it wasn’t like anything they’d seen before. They call it STAX graphite, and it’s as close to ready made for lithium batteries as you can imagine. I mean, we’re not exactly going to just chisel battery shaped boxes out of the ore, but this high grade craziness is the highest grade in the US, in the largest quantities, and THE US DOESN’T PRODUCE ANY GRAPHITE CURRENTLY.

Go read the piece I wrote. It’s worth it, and GPH stock is ridiculously undervalued.

In contrast to the America-First potential of Graphite One is the Sri Lanka-based potential of Ceylon Graphite (CYL.C), which is just now revving its engines having finally gone public.

Merchant banker Sasha Jacob got behind this thing last year, which has a giant land holding in Sri Lanka, a beautiful new highway to take its wares to port, an insanely high grade product that lends itself to the high margin uses you’d hope for, and most importantly, is so cheap to drill for that CYL figures it will grab a drill platform and just keep it working throughout the year, as well as be producing SOON. Early investors are in there because A) Jacob raised some $500 million over the last few years while being a major player in the weed industry explosion, and B) at the sort of costs being incurred, and with the government support they have, there’s just no obvious downside to the CYL play.

MANGANESE:

http://gty.im/90771008

Manganese X (MN.V) called us a few weeks back and said, “Hey, when lithium got big, cobalt followed, then cobalt got big, manganese is coming.”

They were right. We got calls from two other manganese companies quickly thereafter. MN stock has crushed it in the last week, up from $0.16 to $0.205 today in a sudden burst of trading volume, including some from us here at Equity.Guru.

I’m tired, because this has been a long article to put together and beer at lunch is a thing, so I’m just going to send you to the Manganese X project page for more info.

Bottom line: You need manganese to make a lithium-ion battery, at least the kinds of lithium-ion battery that recharge faster, hold a better charge, and don’t cost the earth. Did I mention THERE IS NO NORTH AMERICAN MANGANESE PRODUCTION?

There isn’t. Like the other metals mentioned here, manganese is a ‘strategic metal’, according to the US government, but you currently import it from overseas. Meaning, should we find ourselves in a military conflict involving China or Russia, we’re pretty much screwed.

LITHIUM RELATED SITUATIONS:

http://gty.im/461203458

Nano One Materials (NNO.V) is a company that is developing out a proven technology that allows them to change the formulations for lithium-ion batteries to remove the need for certain elements, or substitute others for them. Which means, can’t find enough cobalt? Lose it. Manganese production taking too long? Get rid.

Of course, I’m being glib here, but that’s the idea behind Nano One Materials, a company that was one of our founding sponsors.

We told you it was coming up in December when it was at $0.45 per share. In January it hit $0.60. Today? $0.70.

Fine. Don’t believe us when we tell you. Just watch it take off and struggle to make rent. Bah!

NNO is completing its pilot plant, which is intended to show big lithium battery types what can be done with Nano One’s patented tech on an industrial scale. If they license that tech out, it’s going to be a rounding error for a Samsung or Panasonic, but major tens of millions for NNO investors. We’ve said all through 2016 this is a play you need to not just watch but get involved with. We said it when the thing was at $0.15 in early 2016. If you listened, you’re on a four-bagger today, and it’s just warming up.

That’s it. I have nothing more. Now, when someone says, ‘what’s with lithium?’ you’ll be able to scratch your head, think about everything you’ve learned here and say, “….Dude, it’s complicated.”

Clearly I have achieved nothing.

— Chris Parry

FULL DISCLOSURE: Almost all of the companies mentioned above are Equity.Guru marketing clients and we own stock in many of them. Graphite One, Lithium-X, and Iconic Minerals are not Equity.Guru clients, nor do we own stock in those companies.