It’s January 2017, President Trump has taken up official residence in the White House and the lithium market remains white hot. Is there a connection? No. There’s no natural reason to trot out the insatiable lithium demand narrative yet again, is there? Well, no, but I will anyway. 2016 was a remarkable year for natural resource investors, almost everyone had a thrilling ride. Lithium stocks were very strong until July, then cooled off through October. Even coal stocks flourished! Gold & silver had huge runs, but ran out of steam in August. Uranium was a complete dud, until all of a sudden, in November, it wasn’t.

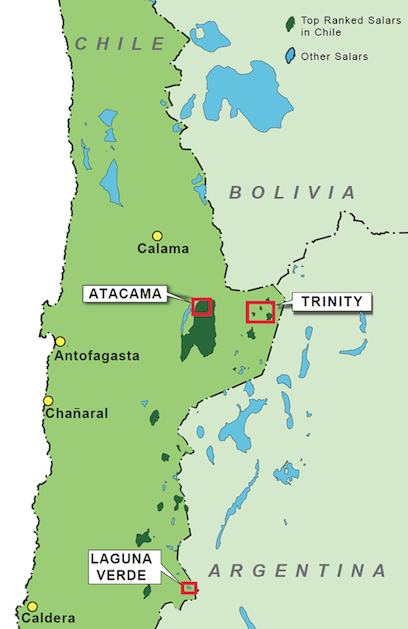

What sectors will be hot in 2017? I have no idea, but if you think Cannabis / Marijuana is the play, then you’re reading the wrong article. This piece is on lithium, where there’s rapidly growing interest in brine projects in Chile. This is a new development in the sector because Chile had been a no-go zone for juniors until about 6-9 months ago. Now it’s a, must-go-make-a-deal-immediately zone, and the stampede is just beginning. First movers like Wealth Minerals (TSX-V: WML) / (OTC: WMLLF), Lithium Power Intl., LiCo Energy and Bearing Resources have a notable head start, but the number of players will likely double or triple before long.

Ok, slow down now, let me catch my breath…. There’s a good reason why Chile hasn’t been overrun by lithium company wannabes, yet…. Like Argentina, Chile is still a place where long-standing relationships, boots on the ground, are not just important, they’re a pre-requisite for doing business. Newcomers to Chile are about a year behind Argentina’s bumper crop, but things are moving even faster this time around. Will the lithium boom outlast Trump’s Presidency?

To find out more, I tapped CEO Henk van Alphen of Wealth Minerals. At the end of the interview, I was fortunate to be able to sneak in questions for Executive Director (Chile), Marcelo Awad and President Tim McCutcheon.

Epstein Research [ER]: Lithium junior management teams with assets across the globe, ALL say they have great, “connections” with the powers that be. How can readers be confident Wealth Minerals’ team truly has strong relationships in Chile?

Epstein Research [ER]: Lithium junior management teams with assets across the globe, ALL say they have great, “connections” with the powers that be. How can readers be confident Wealth Minerals’ team truly has strong relationships in Chile?

CEO Alphen: That’s a fair question, a clear distinction between us and other juniors is that myself, Directors Marcelo Awad and Leonard Harris, President Tim McCutcheon and COO/Director Juan Tang have very significant mineral resources experience in South America, (Peru/Chile/Argentina). Management teams retain lawyers, consultants & deal makers, but if key executives have limited or no in-country relationships, that’s a big problem.

I’ve been investing, working and operating in South America for 26 years, South America is my backyard. Marcelo’s reputation speaks for itself, he’s one of the best known and most respected mining executives on the continent. He opens doors for us that other teams don’t know exist. Our COO Juan Tang has an ideal background for Wealth Minerals, he’s a world-class environmental engineer and has tremendous relationships in China, combined with substantial mining experience in Peru, and he’s fluent in Mandarin, Spanish & English.

[ER]: Is the endgame for Wealth Minerals simply to sell the company to the highest bidder later this year or next?

[ER]: Is the endgame for Wealth Minerals simply to sell the company to the highest bidder later this year or next?

Alphen: We have every intention of advancing each of our projects as far and as fast as we can. Along the way we expect to partner on some or all of our projects. Interest in Chile, in lithium and in our concessions is increasing by the day. We are in talks to lock down additional concessions, but we have nothing definitive to report at this time. While the rush into jurisdictions like Nevada, Quebec/Ontario, even northern Argentina could be about to hit a brick wall, the opposite is true in Chile. We have a very significant first mover advantage.

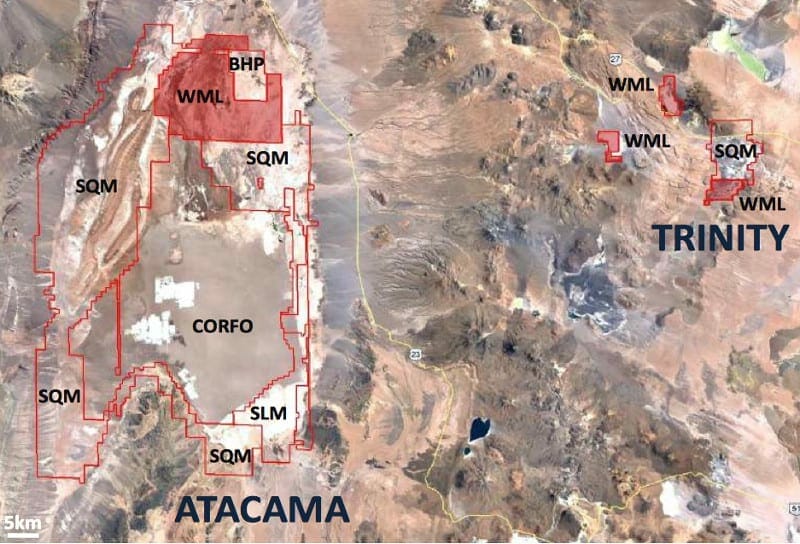

Recent transactions among newcomers and local companies are sending a clear message. The price of playing poker in Chile has gone way up….. Recently, a junior signed an agreement to earn a 50% interest in an exploitation concession in the Atacama. The price of this poker hand? Cash plus shares in the company worth about US$ 9 M. To earn another 10%, the ante goes up again– another US$ 10 M. This project is considerably more advanced then our green field Atacama project, but it’s smaller. Ultimately, we feel this is good for first movers like us if it means followers get priced out of the market.

[ER]: I think you are referring to LiCo Energy’s announced LOI to acquire up to a 60% Interest in the Purickutal lithium exploitation concession. Are there other comparable transactions of note?

Alphen: Yes, LiCo Energy, an interesting company that also has a cobalt play. Another transaction involved Lithium Power Intl. acquiring a 50% stake in the Maricunga project in the Salar de Maricunga. I believe they’re investing US$ 27 M = C$ 36 M in cash, plus 16 M shares in LPI.ax (worth about C$6 M at issuance), for 50% of the project. That’s ~US$ 14,000/hectare, net to Lithium Power. We’re paying ~US$ 660/hectare on our 46,200 hectare Atacama project. Having said that, the Maricunga project is well more advanced.

[ER]: What are the biggest risks facing the Company?

Alphen: Like most natural resource juniors, we are a highly speculative company, exposed to many significant risks. Obviously, a perceived big risk is our choice to build a lithium portfolio in Chile, but we feel we’ve done our homework and have very experienced people who know what they’re doing, so Chile is a risk that we’ve embraced. If Chile was a no-brainer, we wouldn’t have the opportunity we have today. Funding is the other key challenge we will be working hard on this year.

That’s why we’re in continuous discussions with multiple interested parties on a number of corporate initiatives. We expect to fund operations with a combination of cash payments from farm-out partners and equity capital. So for example, we might sell down our 100% ownership in a project to say, 30% ownership, in exchange for being free-carried for a number of years. Doing that would de-risk Wealth Minerals’s portfolio and it’s something we will start doing as soon as this quarter.

[ER]: Are you looking at additional acquisitions? Or, do you have enough on your plate?

Alphen: We currently have 5 projects about 55,000 hectares. As long as we continue to strike great deals, we will go for it. We don’t see signs of a slowing of interest in lithium brines in Chile. We’re looking for transactions that complement our existing portfolio and increase our head start. Each concession we control is one that a competitor cannot, unless they come to us. This year will also be a lot about exploration and moving our projects forward. Shareholders can look forward to brine sampling, geophysics and most importantly drilling, initially focused on the Atacama.

Atacama is host to the best environment for harvesting lithium brines on the planet. We have both the highest grades and evaporation rates. That means desired lithium concentrations from solar evaporation can be obtained 25% to 50% faster, and that’s why the Atacama has the lowest cost production in the word at around US$ 2,500 – US$ 3,000/metric tonne.

[ER]: Marcelo, you are a well known and respected mining executive in South America, with 18 years at Codelco and 16 more at Antofagasta Minerals. You could be actively involved in any company or sector… Why did you choose lithium, and why Wealth Minerals?

Mr. Marcelo Awad: That’s true, I have had the chance since I left Antofagasta Minerals to join big Companies, but I decided to build up a portfolio of Boards and Advising Roles. Fortunately that decision went well. With Henk we’ve known each other for years and last year he told me about his plan to acquire Lithium assets in Chile and asked me if would I assist him to do so. I immediately got interested because I knew his ability and reputation as head of Wealth Minerals and also because I was reading about the Lithium market and the big potential Chile had based on the size of its reserves. I told myself with my mining knowledge, this was a good opportunity to help both Chile and Wealth Minerals in the development of the Lithium business, which will certainly help the Chilean economy.

[ER]: Tim, can you describe the differences among global lithium brine operations / proposed projects? How does Wealth Minerals’ Proyecto Atacama project fit in?

Mr. Tim McCutcheon: There are several factors that determine the success of a lithium brine deposit. One is size of the overall salar, each has a balance of water coming in and going out. A challenge for extracting lithium is to ensure extracted brine is replenished. Water is the mechanism that conveys lithium to surface for processing – no water means no lithium. Larger salars have more water coming in, allowing more to go out, without harming a salar’s equilibrium. Smaller salars face physical limits on how much processing capacity can be installed. As the 3rd largest salar in the world, Atacama has tremendous lithium production capacity.

Grade is another critical factor. Larger salars are older, so there’s been more time for lithium to be deposited, which translates to higher grade. SQM’s grade is 2-3 times larger than many other global brine projects. It’s no surprise that lithium brine extraction was pioneered in the Atacama.

A last factor is aridness. There are many technologies, most unproven at commercial scale, to produce lithium from brine extracts, but by far the lowest-risk is open air evaporation. The Atacama salar sits at low altitude compared to most other lithium-bearing salars. And, it’s possibly the direst place on the planet. Therefore, it has the highest evaporation rate, leading to the lowest production cost in the industry.

Disclosures: The content of this article is for informational and illustrative purposes only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research, [ER] including but not limited to, commentary, opinions, views, assumptions, reported facts, estimates, calculations, etc. is to be considered, in any way whatsoever, implicit or explicit investment advice. Further, nothing contained herein is a recommendation or solicitation to buy or sell any security. The content contained herein is not directed at any individual or group. Mr. Epstein and [ER] are not responsible, under any circumstances whatsoever, for investment actions taken by the reader. Mr. Epstein and [ER] have never been, and are not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and they do not perform market making activities. Mr. Epstein and [ER] are not directly employed by any company, group, organization, party or person. Shares of Wealth Minerals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Peter Epstein owned shares in Wealth Minerals and the Company was a sponsor of Epstein Research. Readers understand and agree that they must conduct their own research, above and beyond reading this article. While the author believes he’s diligent in screening out companies that are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein & [ER] are not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. Mr. Epstein & [ER] are not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Mr. Epstein and [ER] are not experts in any company, industry sector or investment topic.