Lithium investors, stuff’s about to get real. Literally.

In early 2016, lithium went on a hype spike. We watched lithium companies come and go, we saw little guys get big, and big guys get huge, we saw deals that went nowhere and the staking of desert nothingness and companies switching from one metal to the next and back again and, let’s face it, none of it really amounted to much other than junior investors being split between those who got out before the hype spike ended, and those who were crushed underfoot.

Well 2017 is going to get stacked with lithium. No more endless speculation and staking of the parking lot of the Moose Jaw Wal-Mart, now we’re into the second wave, where companies are actually created with a plan to actually drill and actually produce and actually do business.

I know this because the pitches I’m hearing are no longer, “We’re close to Tesla,” or “We’re bordering Lithium-X.” Now I’m hearing, “It’s close to surface,” and “36% of the world’s lithium is produced here,” and “We’re negotiating an off-take deal.”

That smell you’re picking up is the lithium industry cooking right now.

But where to go for a deal that hasn’t already had the life squeezed out of it?

Here’s a company to take a look at:

Canada’s LiCo Energy Metals (LIC.V) has three highlights worth investigating, and an ace in the hole that has us in the Equity.Guru offices giddy.

The first item the company can tick off on its list of assets is Dixie Valley, Nevada The target model is a lithium brine model based on Clayton Valley, Nevada and several basins in South America.

The US Geological Survey Open File Report 2013-1006 lays out seven characteristics of Lithium Brine deposits.

The characteristics are:

- Arid Climate

- Closed Basin containing a playa or salar

- Tectonically driven subsidence

- Associated igneous or geothermal activity

- Suitable lithium source rocks

- One or more adequate aquifers

- Sufficient time to concentrate brine

Dixie Valley reflects these characteristics. Check.

The next on the LiCo Energy Metals checklist was that it had closed a deal that could see them earn 70% of the Black Rock Desert lithium property in Nevada.

We could get all into that (and we will), but that’d be burying the lead, because the other deal is the signing of an LOI to pick up the Chilean Salar de Atacama project, which is lithium central. It’d be kind of like saying “I went to the store for milk today and it was on sale which was great because I’ve been short on cash lately and, oh yeah, Charlize Theron was pole-dancing in the meat section.”

And if that’s not sexy enough, we haven’t even mentioned their Teledyne Cobalt project yet.

The market has liked this news.

So you want details? Let’s start with what’s closed:

LiCo […] announces that further to its news releases dated November 11, 2016 and December 15, 2016 […] pursuant to an Option Agreement dated November 10, 2016 between the Company and Nevada Energy Metals Inc., whereby the Company can earn an undivided 70% interest, subject to a 3% net smelter return royalty (“NSR”), in 199 placer claims located in southwest Black Rock Desert, Nevada, the transaction has now closed, subject to final acceptance of from the Exchange.

The western arm of the Black Rock Desert covers an area of about 2,000 square kilometers and contains 5 of the 30 currently listed Known Geothermal Resource Areas in Nevada. The Property covers an area of playa underlain by a moderately deep basin interpreted from gravity and seismic surveys indicating a maximum thickness of valley-fill deposits of about 1,200 m/ 3,600 ft. A high salt content prevents any significant vegetation from growing on the playa surface. Locally, the basin is being fed in part by boiling springs and siliceous sinter containing strongly anomalous Lithium values (5mg/l) that flank the property on the west side. While these lithium values are well below those of producing lithium brines, they do represent a significant source of metal available for evaporative concentration within the playa basin.

Cool cool cool. So, what we’re looking at here is not promo-fodder. This isn’t a “we’re going to a billion dollars tomorrow!” deal. It’s a “If we plonk down the equipment and set up an evaporation pond and let the hot Nevada sun do its work, we can go over a few times per month and haul off a bunch of lithium without breaking a sweat” deal. That’s solid business building.

To get the 70% interest, the company has to “pay to Nevada a total of USD$170,000. The Company will also issue to Nevada 1,500,000 shares upon Exchange approval. In year one the Company will issue to the Nevada 1,500,000 shares followed by an additional 1,500,000 shares in year two. The Company is also subject to a US$1,250,000 work commitment on or before the three year anniversary date.”

Mostly paper, a little cash, and work done. Solid, low risk move that is easy to shift to production if it all goes as one would hope.

And then there is Chile. We like Chile.

The Company entered into a non-binding Letter of Intent (LOI) with Durus Copper Chile Spa, of Santiago, Chile, whereby LiCo can earn up to a 60% interest in the Purickuta Lithium Concession located within Chile’s Salar de Atacama, the world’s largest and purest active source of lithium.

The LOI, when superseded by a definitive option agreement, will require LiCo to make cash payments totaling USD$8.4 million, issuing 5 million shares and making work and development commitments during the term of the option agreement.

If you’ll excuse the parlance, this deal is BALLS DEEP in lithium production potential.

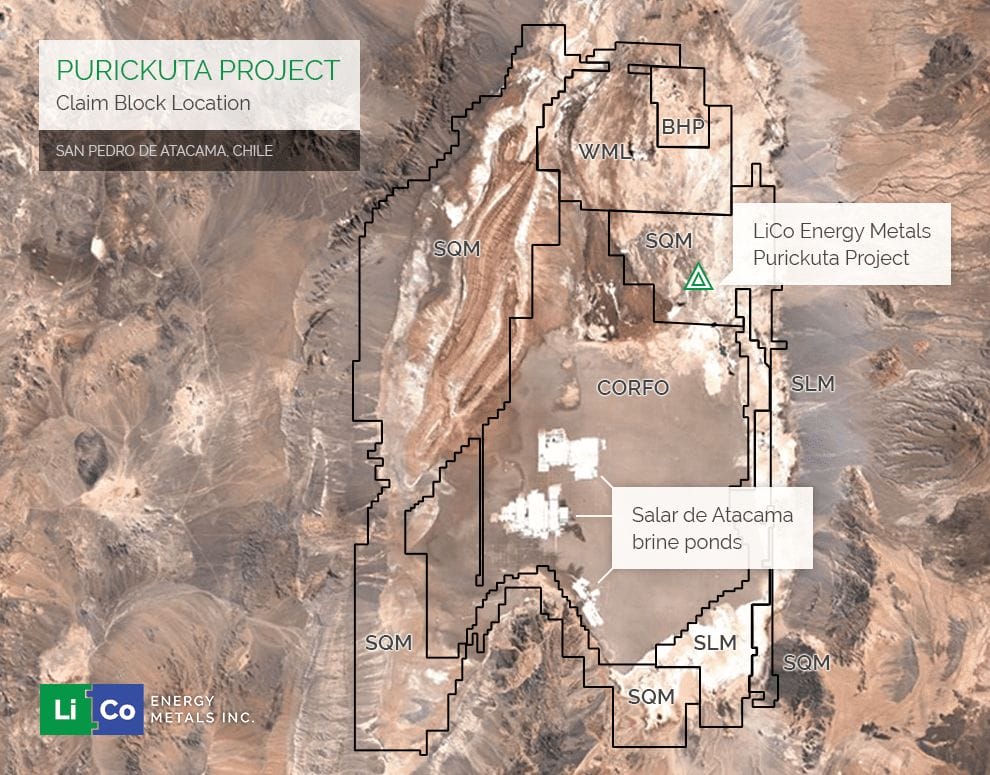

As mentioned, the Salar de Atacama is the global centre of lithium production. If you check out the photo below, that big splotch in the middle, where it says ‘Corfo’ – that’s where boatloads of the global supply of the stuff come from.

Corfo is Chile’s economic development agency, and it controls who can crank out lithium and how much it gets to crank. You can see in the image that it’s fairly surrounded by lithium giant SQM and others.

That little green triangle butted up against it? That’s where the LiCo property is. The white areas in the CORFO zone are brine ponds that currently produce a wealth of lithium – in fact, a sizable amount of the world’s supply. Note the colour surrounding the LiCo plot.

Let’s be clear – $8.4 million in cash and about $750k of stock is not a cheap buy-in, but that’s kind of the point. We’re not talking a rabbit hole with some sludge in the bottom here, and we’re not squeezing yet another 18 feet of desert space in the Clayton Valley into a portfolio of assets and claiming it’ll be the next Albermarle.

The plot is legit. It’s significant. It’s a chest thumping Tarzan yell compared to the meek squeaks that have come from so many lithium juniors in the last year.

At a $10m market cap, with a $9m deal in the mix, LiCo just got real – right at the time where ‘real lithium deals’ are what everyone is looking for.

But wait, as they say in the TV infomercial game; “There’s more.”

Cobalt: Lithium’s counterpart

Oil is beginning its descent, and lithium ion batteries are taking over. But to make one of those, you’ll need lithium (lots of it), and you need certain kinds of graphite, and you also need COBALT.

Cobalt is where it gets tricky because most of that is found in the Democratic Republic of the Congo, where ore is dug out of deep holes in the ground by kids hanging from ropes. No, really, that’s how today’s modern day supply of cobalt is sourced.

Most of the world’s non Congo-based cobalt supply comes from the mining of nickel and copper, which means when those metals slump, cobalt supply dries up.

Clearly we need a better option. If only there was a place where cobalt could be found as a stand alone metal somewhere that wasn’t a child slave labour dictatorship…

Coming soon:

You may have noticed the name LiCo Energy Metals is made up of the symbols for lithium (Li) and cobalt (Co). Why? Because, there’s a cobalt element to this deal too.

LiCo has another property near the town of (and I’m not making this up) Cobalt, Ontario, so named because cobalt was dug up on the regular nearby.

The previous owners of the LiCo cobalt property had spent $25 million (inflation adjusted) on it. LiCo will not be spending anything close to that.

LiCo Energy Metals has entered into an option agreement to acquire up to a 100% interest with a 2% net smelter royalty of the Teledyne property [which] consists of 5 mining claims and 6 staked crown claims in the Buck and Lorrain Townships, located in the district of Temiskaming, Ontario. The project covers 115.5 hectares of mining and surface rights, with an additional 439.1 hectares of staked crown claims. The property is easily accessible by highway and a well-maintained secondary road.

Yes yes, but what’s it got? Let’s skip to the highlights:

- Based on the 1979-1980 drilling results, probable and inferred reserves accessible from the current ramp are estimated to be in excess of 95,000 tons at 0.45% Co.

- Over $25 million (inflation-adjusted) of past work has been already been completed on the Teledyne Property. This work has resulted in valuable infrastructure, which includes a development ramp and a modern adit going down 500 feet parallel to the vein.

- Located within a historic mining camp that dates back to 1903, and was one of the world’s largest silver camps in the early 20th century. An estimated 18 million kg of silver and 14 million kg of cobalt has been produced here.

- Previous owner, Teledyne Canada Ltd., completed a diamond-drilling program consisting of 6 surface drill holes in 1979, with another 22 holes drilled from underground to confirm the previous surface drilling a year later.

<miner talk>

4 of the 6 surface drill holes intersected ore grade cobalt (>0.10% Co); individual cobalt grades to 10.6%, and 18 of the 22 underground drill holes intersected ore grade cobalt (>0.10% Co); individual cobalt grades to 10.2%. The average grade/core width from the 22 holes equalled 0.57% Cobalt/ 1.6 metres core width. This zone remains open to the south with a further 650 metres of potential mineralized strike length on the Teledyne property, and represents an excellent target for a future drilling campaign.

</miner talk>

Often, when talking of mining projects at an early stage, the reality of what things look like on the ground is tough for an outsider to grasp. Is it forest with some stakes around it? Is there a road? Has anyone actually dug a hole?

Yep.

Let’s recap: The company just went definitive on an LOI for a $9m deal to get a lithium property a stone’s throw from where 37% of the world’s lithium is produced. They have in excess of $1.5 million in the bank. They have a Nevada based property with lithium lying about on the ground that they picked up for couch change. They have a cobalt property IN COBALT, ONTARIO, with $25 million (inflation adjusted) already spent on it.

And their market cap is $10 million.

I’m going to just leave that there and let you think about this for a second.

Hey, by all means, don’t buy it but, for god’s sake, stick it on your watchlist and get to know it early.

ADDENDUM: Know your cobalt! This helpful Visual Capitalist infographic will get you up to speed.

— Chris Parry

FULL DISCLOSURE: LiCo Energy Metals is an Equity.Guru marketing client, and the author is purchasing the stock on the open market. Do your own due diligence and please see a qualified financial advisor before making any investment decision.