Credit where it’s due: When most cannabis companies put out news that a new grow facility is coming, they’ll talk about square footage and how big the industry might one day be.

When Marapharm Ventures (MDM.C) announces a new building, you get informed on the finer details.

Marapharm Ventures Inc. (“Marapharm”) announces that construction on its 7 acres of property located in the Apex Industrial Park in Las Vegas Nevada is underway. November 14, 2016 it was announced that two 5000 sq. ft. starter buildings were ordered from Ceco Buildings. The order is now complete, the buildings have been manufactured and are on schedule for delivery on December 19th. Preliminary site work is done and the building site has been mobilized with Patriot Grading preparing the site for forms and slabs. Signage with the company logo and the slogan “watch us grow” is prepared on a 12 foot by 20 foot billboard to be erected on the site. Master and temporary fencing and dust permits are in place. A deal has been done with the Master Association for dirt which is needed for construction and the material is available at no cost to Marapharm.

The Master Association of Dirt. Well there’s an organization that’s well suited to be based in Vegas.

A day earlier, the company released more news about the financing of said Nevada property, which will be used to house three medical marijuana licenses.

“We’ve received several million dollars recently from warrants being exercised by loyal shareholders, with more coming in daily, and we decided to pay off our debt, which is this one mortgage. We paid $445,500 USD for the property and financed $309,000. In addition, we paid taxes and fees and posted about $100,000 for wet and dry utility bonds. We’ve also done improvements on the site and have invested more than $100,000 on site and facilities planning. And we’ve paid for buildings that are to be delivered within 3 weeks and erected for cultivation.”

Hey, let’s go deeper.

“The monthly mortgage payments were $2,785.22” said Linda Sampson, Marapharm CEO and she added “paying off a relatively small mortgage and paying $110,000 cash for the 1.1 acres may not sound like a big deal but, to us, the significance is that we did what we planned to do in terms of reaching our milestones.”

In contrast, it took good old early stage weed pump and dump CEN Biotech (FITX) two years to build a wire fence, while claiming it would have the world’s biggest marijuana factory ‘any day now.’

Marapharm is used to moving quickly. The company has manged to cobble together 300,000 sq. ft. of medical marijuana licenses in Washington State and Nevada, and has an application with Health Canada for a 22,000 sq. ft facility license under the ACMPR program, which is currently at the security review stage.

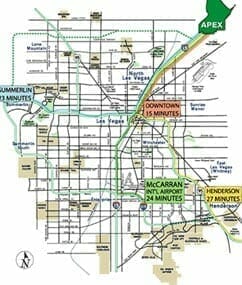

The Nevada location is quite the coup for MDM, being as Apex Business Park is an initiative to rapidly expand the North Las Vegas economy, with big players such as Faraday Future Auto setting up on site, and local government promising open zoning and rapid permitting approvals, not to mention on-highway logistics and close-to-the-Strip access to 50 million tourists per year.

The Nevada location is quite the coup for MDM, being as Apex Business Park is an initiative to rapidly expand the North Las Vegas economy, with big players such as Faraday Future Auto setting up on site, and local government promising open zoning and rapid permitting approvals, not to mention on-highway logistics and close-to-the-Strip access to 50 million tourists per year.

MDM is also moving into California, with an agreement to purchase an industrial facility in So Cal and three medical marijuana licenses in place for cultivation and retail. On top of that, they have announced the acquisition of a hemp oil product, coming to market early next year, and a dispensary vending machine system.

The company briefly enjoyed a several day spike to over $2.40 per share, during the great mini-bubble of November 2016, but has now settled to a much more value-based $1.63, placing it at a market cap of $95 million.

With three-state and one-province exposure, and a rapidly liberalizing US weed space, Marapharm is one of the first multi-state movers, and is building a name for itself almost as quickly as it’s building it’s buildings.

— Chris Parry

FULL DISCLOSURE: Marapharm is an Equity.Guru marketing client, and the author owns stock in the company purchased on the open market.