A few months back, I put out a podcast with the CEO of a company called Transatlantic Mining (TCO.V). You can listen to it below, if you need to catch up.

The CEO, a fellow aussie by the name of Rob Tindall, said his company was going to raise a small amount of money and go move quickly to small scale production at their historic US Grant mine in Montana.

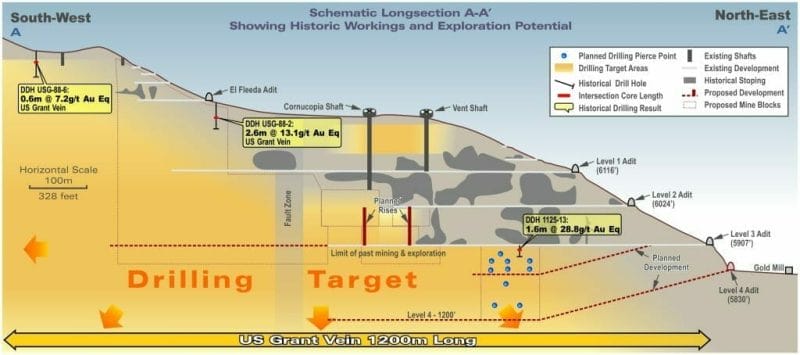

And when I say historic, I’m not blowing smoke. The original mine permit was signed by Ulysses S. Grant. Production went hard there from 1867 to 1984. It’s got infrastructure, shafts, a mining friendly jurisdiction, and no question that there’s gold around.

But Transatlantic didn’t want to screw about raising many millions to poke a hundred holes and get a fat resource estimate, not when they knew there’s gold sitting about waiting to be sifted. They wanted to go right into the piles of ore already present, run them through the mills already present, and use the revenue to get stuck in and learn more as they go.

Or that was the promise.

The company announced a financing on June 26 of this year. They were offering 50 million shares at $0.05, to raise $2.5 million, which they said would be all they need for a long time.

So where’s the close? Gold is up, gold companies are up, and TCO has been silent.

I like Tindall, and I like NY-based analyst Peter Epstein, who I often hand over these pages to talk about companies he likes. And he’s liked TCO enough to be chomping through free market paper for some time now. Pete tells me he’s confident a close is coming, but that he’s had his patience tested by the length of time it’s taken to move forward.

Time for Transatlantic to show their junk and prove their manliness. Do they have their raise ready to close? Are they really sending ore to the grinders? And on a lease that has about eight months left on it, does it even matter?

I bought a little TCO a while back on the strength of that podcast, and it hasn’t burned me yet. Price is level (though it has bounced at times) and the company has yet to get the 3x spike that other goldies have received over the past few months.

But I want to see the thing moving. I want to see evidence that this isn’t a shell in the making, that the long halt it endured under a previous incarnation was not related to what’s happening now, I want to see real movement forward.

Hell, even a base resource estimate, even if it’s just a small starting point, will help show this mob are real. Let’s see some activity. And let’s see it, like, tomorrow, so we can get some of this stuff ground up.

http://gty.im/456320924

Pete’s on one side of the fence. The market is on the other. I’m in the middle.

And I’m getting splinters.

— Chris Parry

PS: 260 million shares out? Maybe roll that shit back, lads.