EDITOR’S NOTE: Todd Aalgaard is a journalist I worked with back in my Postmedia days, and I’ve asked him to put together a series looking at some of the personalities behind the Canadian smallcap investment space. He brings an outsider perspective, which I think is important in a space that is increasingly over-connected and intertwined, and his first profile is of a guy who has achieved more in his first dozen years of adulthood than many will in fifty.

Tommy Humphreys is a smooth operator. A cocky, knowledgeable, successful, connected, and risk welcoming mover-shaker with a track record of investing home runs.

This is no advertorial. He didn’t pay for the coverage. But he’s interesting enough to warrant it and his site is an increasingly important place to figure out if your preferred trade is a good or bad one.

Over to you, Todd.

Put simply, if business — specifically that of the investment world — is like swimming in a shark tank, it stands to reason that you should know how to swim really, really well. To stay afloat, says Tommy Humphreys, you need one thing more than anything else: information.

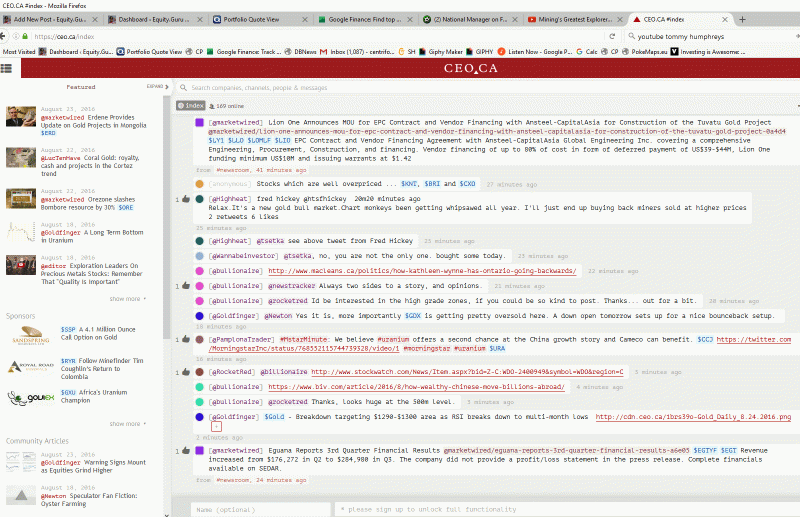

That, he says, is the entire purpose behind CEO.CA, a now four-year-old venture that stays ahead of the shifting, changing circumstances of business, integrating editorial content with social media-style live chat, with financial data.

The 30-year-old Vancouver-based entrepreneur kicked off the site in 2012, bringing what he describes as a real-time touch to business forums that, before its inception, tended to be more static. What investors need, he said — and what the sites of the time weren’t delivering — is a better, more fluid way of delivering information that can keep investors ahead of the market, everything from whether or not there was an accident at a mining site or what’s happening in the offices of another company to who is sitting on nice drill results.

Not surprisingly, he says, how fast his users get such information is what makes or breaks an investment call. If you’re one of the first few investors to hear about important news about a company you’re invested in, you can get out fastest – or double your investment before it lifts.

“We have a real-time newsroom built into the site,” Humphreys says, noting one of CEO.CA’s key features, “and so we’re beating some competing financial information products by ten minutes, fifteen minutes. Sometimes that’s very material.”

Built into the site’s smooth, intuitive social media-style console is a listing of stocks broken down simply, by a combination of their respective stock symbols. On an individual stock’s page, a full stream of information is available, and made available fast, including what people are saying about the stock, its chart performance, and so forth.

That public engagement, though, tends to be the most crucial part of CEO.CA’s chemistry — especially today.

Equity.Guru honcho Chris Parry is often found in CEO’s chat space.

“I can chase a CEO around and try to get a comment about what they’re up to, or what they think of the wider economic situation around us, or I can go to CEO.CA and watch them talking to geologists, other CEOs, other business writers like Eric Coffin and Peter Epstein, and some of the bigger investor types in town,” says Parry. “I tend to take the lazier option, and it’s often surprising what you hear and see when these guys are in a room together shooting the shit.”

It’s not always pretty, and occasionally stock promoters invade the space to push whatever they’re selling this week, but for the most part it’s something not found on the internet so often: An intelligent comments section that doesn’t make you hate humanity.

Originally, CEO.CA was just a WordPress blog, Humphreys recalls, with few capabilities beyond articles about a variety of companies. Since adopting more of a social media-styled, channel-based design though, drawing essentially crowdsourced information from experts and others, that format has become much more dynamic. And with tickers of stock data and real time reporting on the shifting sands of business, the site, detailing a bad stock here or a risky stock there, can seem sometimes like a public service.

In addition, Humphreys’ knowledge of the mining business is so strong that he manages to open doors to people usually far out of reach of the average investor.

Still, Humphreys says, it’s not like the site has a charitable mandate to be altruistic. It’s about one thing: making money in a high-stakes game, and doing so by giving others the information they need to succeed.

“We’re not like angels,” Humphreys says, taking care that people don’t get the wrong impression about CEO.CA’s mission. His particular investment scene is a race like any other, and the idea is to get ahead, and to get ahead fast. The thing to remember, he says, is that the stakes in such investment circles tend to be higher. Then again, he adds, so is the payout when things go well. The trick is in making sure they do.

“These are high-risk stocks, and we’re benefiting tremendously this year,” Humphreys says of his network. Last year, for example, his company had two weeks’ worth of cash in the bank and things were looking grim at one point. In 2016, however, with the CEO.CA model having turned more than a few informed, engaged heads in the investment world, that’s definitely changed.

“All the stocks that we’re following are skyrocketing, so our whole community is making money,” he notes. “It’s an easier, more comfortable position, as you can imagine.”

Humphreys calls it “crowd-sourced wealth creation,” and in drawing from a deep pool of knowledge, the CEO.CA community, he says, has identified the big fish early, making users the sharks themselves.

An example? When Nexgen energy shares were under $0.35, Humphreys recalled, the stock was followed closely by a variety of CEO.CA users, with content ranging from shared site visit reports to interviews with key stakeholders detailing what investors needed to know to make an informed decision.

Today, that stock has soared to over $2.50.

Another is Gold Rock Mines in Argentina, profiled in March 2016 with a CEO.CA post describing it as “an Argentine gold project whose time has come.” In the three months since that post was made, Fortuna Silver took the gold operation over, and shares have swelled by more than 500%.

Another way that information is conveyed is through access to smallcap company CEOs, something Humphreys calls “unprecedented.” Humphreys is regularly invited to Vancouver and Toronto boardrooms, or to the private jet of mining legend Robert Friedland, or to an event with his long time mentor, Frank Giustra, putting readers at CEO.CA within reach of information not usually shared with the small guy. That access gives users an all-important sense of a company behind the scenes — something that can be crucial when deciding whether or not to support the company financially.

In all its forms, information is the fuel behind CEO.CA and, for the Vancouver-based operation, the future is looking bright. A lot brighter than last year, anyway. Nonetheless, Humphreys — very much aware of the stormy seas of the investment world — knows better than to get overconfident too soon.

“We’re growing like weeds,” Humphreys said, “but we have a long way to go.”

— Todd Aalgaard