Well, it’s no LIX, but with the current swathe of companies dashing into the lithium space, hoping to hitch a ride on the greater sector’s coattails, we’ve started to take a closer look at the sector and will now commence regular coverage of Resolve Ventures (RSV.V), among others.

Resolve has emerged from the ashes of mining projects previous, tooling up with a $0.05 private placement financing, and zooming out the other side of that with a six-bagger, having hit $0.29 before basing out at $0.23 today.

I got me a piece of that placement, so I’m pretty stoked at where the company sits today, even if all they’re sitting on currently is 50% of an unworked lithium property.

The lithium craze has been nutso of late, with people making five and six times their money in weeks. That’s come on the back of amazing pre-sales numbers for the upcoming ‘affordable’ Tesla model, the continuing moving towards reliance on rechargeable batteries and electronic vehicles, and good old-fashioned pack following.

Resolve’s financing was for half a million bucks, which pretty much covers the cost of the property acquisition with some ‘lights on’ funding tossed in. That’s no slight on the company – considering where the share price is today, limiting the financing to just what they needed to close the property deal was a smart move. As the company looks to play out its new lithium future, it will likely need some more dollars, and raising future dough at $0.23 instead of $0.05 is nothing to sneeze at.

But it may not need to rise at all, given there’s another $500k in warrants from that placement at $0.105, which will no doubt fly in the door, filling the war chest further.

There are many companies now that are ‘in the space’, many of which are legitimately years away from ever producing lithium. But, just as with the weed rush of 2014, there’s cash to be made right now on betting where investor money will flow, rather than whether revenues will come back the other way, and nobody is losing bets on lithium at present.

Will Resolve produce lithium? No clue. But if it spent $500k getting 50% of that property in Nevada, right in close to the proposed Tesla Gigafactory, and you can bet someone else out there is getting ready to offer them ten times that initial investment the moment they find the brine.

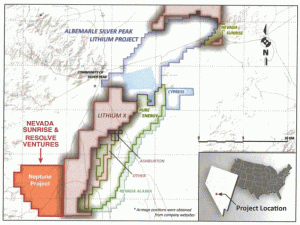

Why would someone want Resolve’s property? Well, take a look at this map and tell me what you see:

That’s right – the Resolve play butts right up against the sector monster that is Lithium-X. You may also recognize Pure Energy (PE.V), which recently had an explosive run from $0.40 to $1.00 in quick time..

That big blue blob to the north? That’s the producing Silver Peak lithium mine, which has cranked out 6000 metric tons of the stuff since the 60’s and was recently part of a billion dollar deal. Certainly worth a stab.

The RSV financing stock is untradeable until September, and that may present an issue if everyone decides to cash in their profits at once when it frees up. So the challenge to Resolve management will be, what can they do in the next three months to make people as likely to sell their stock as they are to buy all the Transformers films on Blu-Ray?

Also going to take a look a bit later at American Lithium (LI.V), which has tracked a big upswing of late and looks to be engaging a large scale plan.

If you have a favourite lithium play that you think we should add to the mix, leave a comment below. even you LIXers..

–Chris Parry

http://www.twitter.com/chrisparry

FULL DISCLOSURE: The author owns stock in Resolve.

Hi Chris,

Are you suggesting the Resolve has taken part of Nevada Energy’s Neptune project? What do you make out of the recent announcement by PE on their phase 2 sampling results?

Br, Fritz